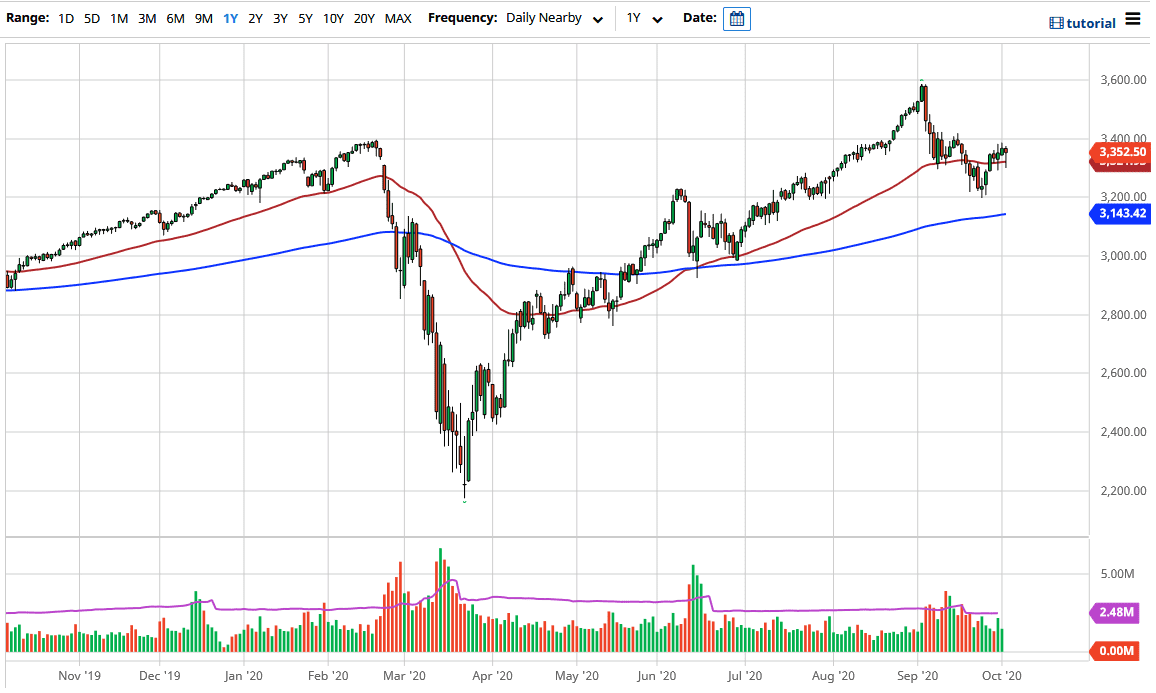

The market looks very likely to see a lot of volatility, and we are likely to continue to see resistance at the 3400 level. The question now is whether or not we can break above there, as it has been so resistive lately. One thing that I would point out is that the market certainly looks as if it has buyers underneath, but there are signs of the US dollar trying to strengthen in the currency markets, and that will more than likely cause quite a bit of negativity and downward pressure in this market.

If we break down below the bottom of the candlestick for the trading session on Friday, it is very likely that we go looking towards the bottom of the overall consolidation, which is between 3400 on the top, and 3200 on the bottom. I think we are going to stay in this range for the short term, as the presidential election nears. It is very likely that there will continue to be a lot of noise in general. Furthermore, do not be surprised at all to see something over the weekend cause chaos in the markets at the open. There are a whole plethora of things that could cause problems.

If we do break above the 3400 level, and perhaps even more importantly the 3420 level, then the market is likely to continue to go looking towards the upside, perhaps as high as 3600. On the other hand, if we were to turn around a break down below the 3200 level, then it is likely that we are going to go looking towards the 200 day EMA, which is currently at the 3143 level. Breaking down below there, it is likely that the market could go to the 3000 handle. Obviously, this is a market that tends to move in 200 point ranges, so that is a fairly easy call to make. I like the idea of waiting for break out, but I recognize that short-term traders will more than likely trade back and forth. Ultimately, the volatility is probably going to get worse, not better.