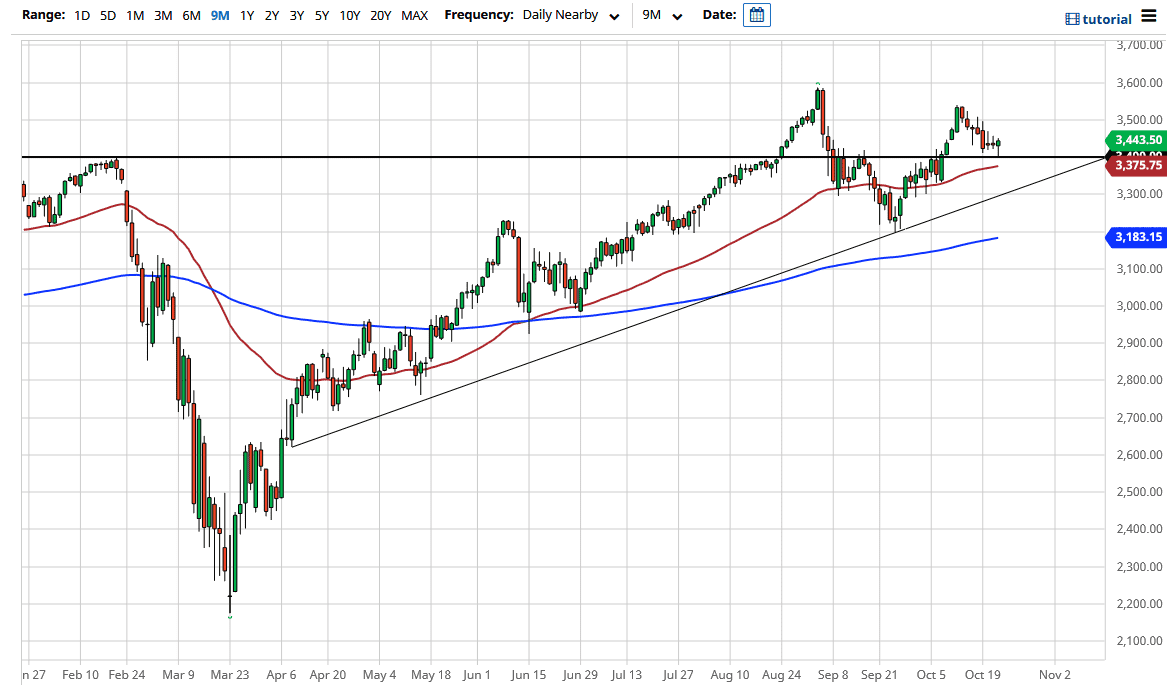

The S&P 500 initially fell during the trading session on Thursday to reach down towards the 3400 level. This is an area that is previous resistance, and therefore it is likely that we will see it as potential support. After all, “market memory” comes into play. With this being the case, the fact that we bounced to form a hammer is not a huge surprise, but it should also be noted that a lot of the selling was done during the Globex session, so at this point it comes down to whether or not there is any true belief about the market falling. The unfortunate reality is that people are waiting around trying to figure out whether or not there is going to be any stimulus and you would also be forgiven for thinking that this could be a “sell the news” type of reaction. After all, that happens quite a bit and everybody pretty much assumes there is going to be stimulus.

At this point in time, the 50 day EMA sits just below the 3400 level as well, so I think at this point we are likely to see a bit of support. I think it is only a matter of time before somebody comes in and try to pick up the S&P 500 “on the cheap” but be aware the fact that a couple of bad Tweets or rumors could send this market right back around. Furthermore, we also have the presidential debate during the evening hours, so it is also possible that is a potential catalyst for volatility as well.

Having said that, and I have made no bones about it, this is a market that you only buy. You never sell indices because they are not designed to fall. It takes a very specific set of events to have them sell off drastically, so you are either buying it or you are flat. That being the case, I am very cautious, but I certainly have no interest in shorting. In fact, unless we break down below the uptrend line, it is likely that there are plenty of buyers underneath to pick this up. As we close out the cash session in New York, traders are banking on the possibility that stimulus is almost certainly coming. More of that hope coming through. Wall Street loves cheap and free money, and we would not be in an uptrend over the last 12 years if that was not the case. I do not see that changing.