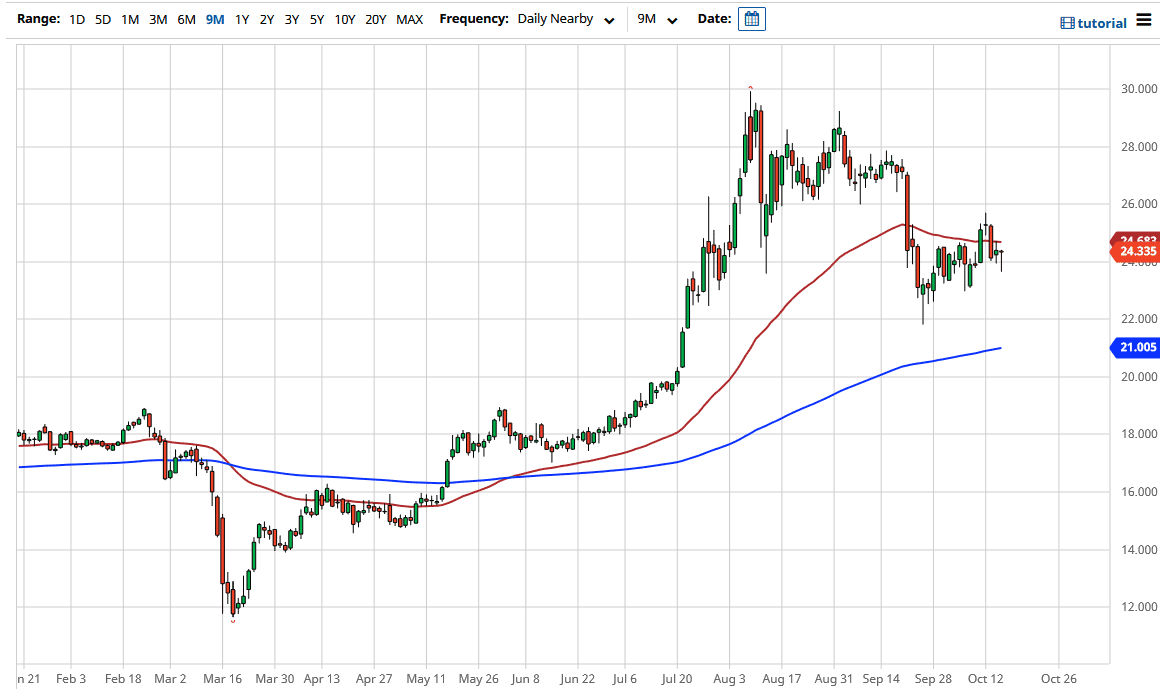

Silver markets fell hard during the trading session on Thursday, piercing the $24 level. By breaking down below there and turning around to form a bit of a hammer, that of course suggests that there is a lot of buying pressure underneath there. The hammer of course is a bullish candlestick, and it suggests that there are still people out there willing to buy silver. I am one of those people as well, but I also recognize that you will have to pay close attention to the US dollar, because it has a massive negative correlation with silver.

With central banks around the world continuing to liquefy and loosen monetary policy, that suggests that silver will eventually find plenty of buyers. Granted, gold probably does better in this scenario because silver also has a major industrial component built in, and it is possible that there will not be much in the way of industrial demand. Because of this, I think silver probably underperforms gold, but it probably moves in the same direction and for the same reasons.

The 50 day EMA sitting above is flat and it suggests that there is probably a real lack of upward momentum, but ultimately, I do think that we eventually break above there. That does not mean that we will pull back further before it happens, and if you are a longer-term bullish like I am, it is not a big deal to buy little bits and pieces along the way in order to build a larger position. I recognize that the $24 level is supportive, but then I would also say the same thing about $23, as well as $22 after that. The $20 level was an area where we had broken out of previously and should now have a certain amount of “market memory” involved. The 200 day EMA sits just above there, so it is only a matter of time before buyers would get involved from what I see. Ultimately, if the US dollar falls apart then we may just take off to the upside, looking towards the major supply area at the $27 level. I do believe that the US Dollar Index should be paid close attention to, because it will give you an idea as to what this market does next. Ultimately, I do not have any interest in shorting silver anytime soon.