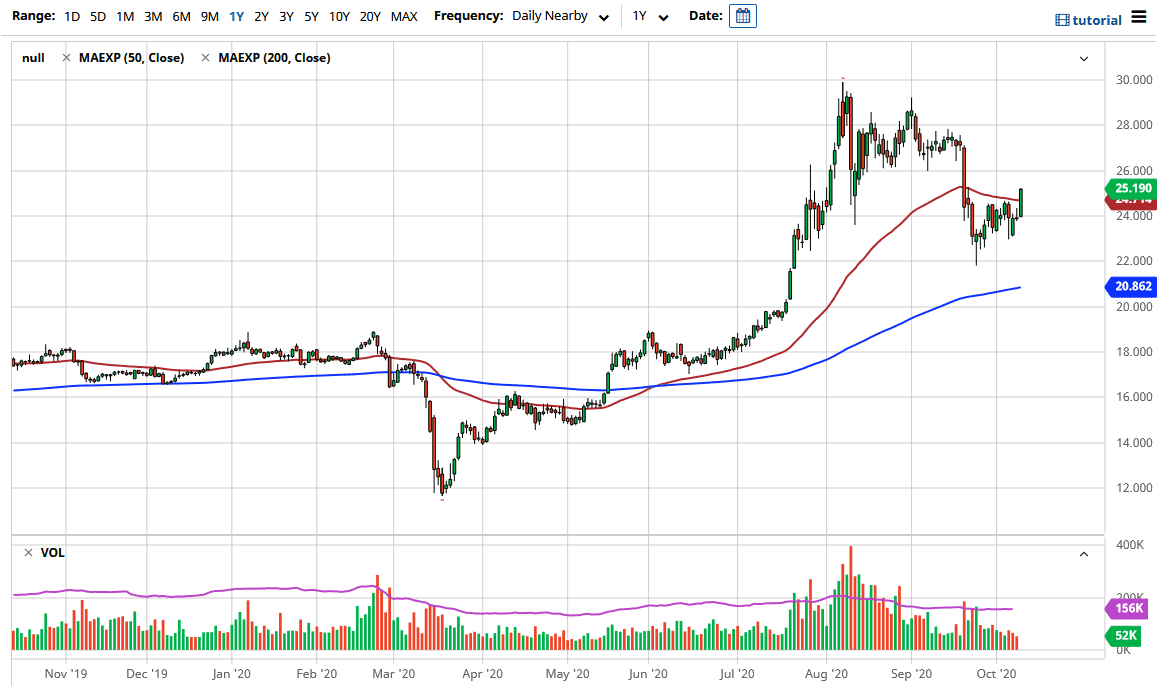

Silver markets have broken to the upside during the trading session on Friday, clearing the 50 day EMA which is a strong technical signal. Perhaps even more importantly, the market has broken above the $25 level as we have started to price in the idea of “guaranteed stimulus.” Unfortunately, the stimulus is still something that is not necessarily a given, but the market certainly is trading as if it is.

Looking at this chart, we are closing at the top of the candlestick and that is a bullish sign. At this point, we will have a significant amount of buying pressure underneath near the $24 level at the base of the candlestick for the trading session on Friday. If we do get stimulus, then that means that they will continue to sell the US dollar and that will certainly send silver much higher. On the other hand, if we were to get some negative headlines when it comes to the possibility of stimulus, silver markets will get hammered. Silver markets are highly levered to what happens with the US dollar, and therefore the negative correlation should continue.

If you have been following me here at the Daily Forex, you know that I have not advocated selling silver, and this candlestick on Friday is a perfect example of why. Because of this, I believe that it has been a “buy on the dips” type of situation, but you should be cautious about your position size. To the upside, it looks very likely that the $27 level will offer resistance as it was a significant amount of supply, but the longer-term trend still remains very bullish, so I do not even know that I would necessarily be overly concerned of the $27 level, although obviously there will be some type of reaction there. I think if you pull back to the short-term charts, it is very likely that we are going to find plenty of short-term buying opportunities. The $22 level underneath is a bit of a “floor” right now, so having said that we now move the “basement” higher, as we could not reach down to the crucial 200 day EMA quite yet. Ultimately, this is a market that I think continues to find plenty of value hunters jumping into it overall.