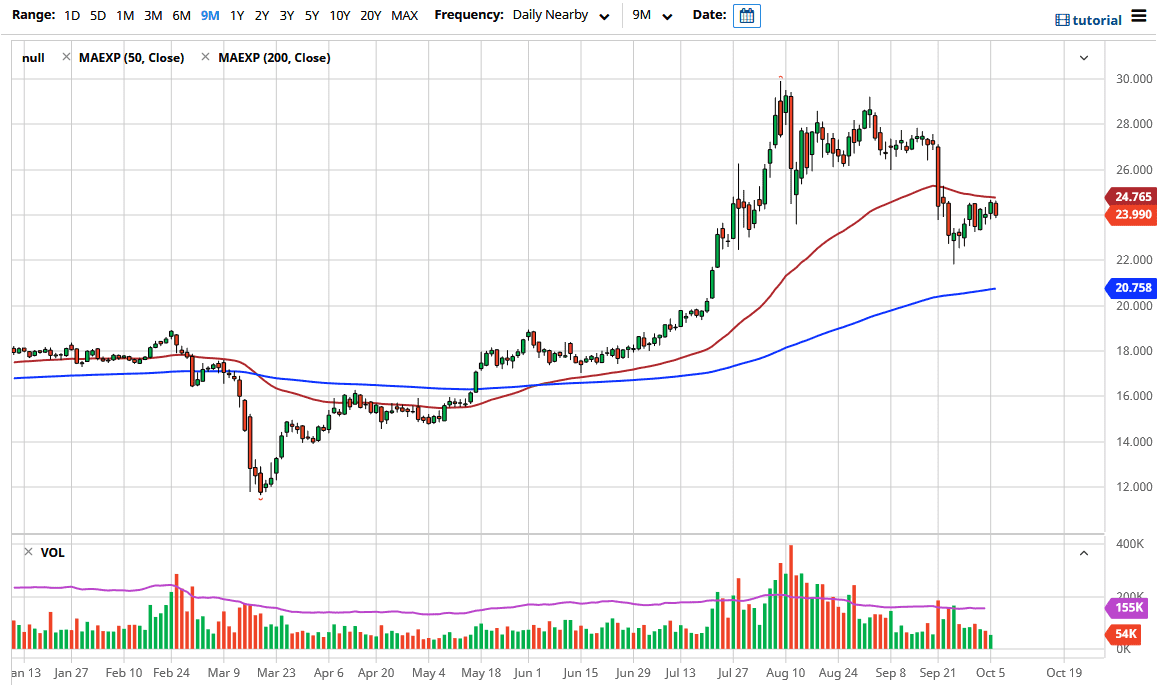

The silver markets have pulled back from the 50 day EMA again on Tuesday to reach down towards the $24 level. This suggests to me that the market is going to continue to drop from here, especially if the US dollar continues to strengthen a bit. Lately, the US dollar had been oversold, so it strengthened and sent silver much lower. We have since bounced from the $22 level to reach towards the 50 day EMA. The area attracts a lot of attention, so therefore it is not a huge surprise to see that we have struggled to break out.

The market breaking above the 50 day EMA on a daily close would be something to pay attention to, and at that point, I would be more than willing to jump in and start buying silver. Until that happens, I suspect that we will continue to have a lot of risk to the downside. At that point, the markets are very likely to continue to be a “fade the rally” type of situation. If you break down below the bottom of the candlestick from Tuesday could send this market to the $23 level, and then down to the $22 level. That is an area where we had seen a lot of interest in silver, but I think there is an even more interesting level underneath there in the form of the $20.00 level. Just above there, we also have the 200 day EMA so it is likely that we will continue to see a lot of interest in that general vicinity.

Keep in mind that the negative correlation between the US dollar and silver should continue to be relatively strong, but this can change over time. In the short term, the negative correlation has been roughly 98% over the last couple of months, so by paying attention to the US Dollar Index, you can get an idea as to where the silver markets will end up going. All things being equal, if we do break above the 50 day EMA and get a daily close above there, then the market could go to the $26 level, followed by the $27 level where there is a significant amount of supply as seen from the major breakdown that occurred. I think the one thing that you can probably count on is a lot of choppiness.