The children that call themselves politicians in the United States cannot really be counted on for much, but as things stand while I was recording this video, people are assuming that there is going to be some type of stimulus it will drive down the value of the US dollar. If that is the case, then it makes sense that silver would gain due to that. Having said that, one minor detail that has been overlooked for a while is that this will be the fourth round of stimulus.

Because of this, it is difficult to imagine that the market would be one that can easily move based upon the stimulus situation in and of itself, because we have seen absolutely no hint of inflation, something that a lot of traders are basing the predictions of higher precious metals pricing. This does not mean that it does not happen given enough time, but it is going to take a while before we get that type of inflation. Nonetheless, flooding the market with fiat currency almost certainly will drive up the idea of “hard assets”, which of course is a major driver of why people buy silver, as well as the potential of industrial demand. That being said, there is probably going to be a significant problem with industrial demand, so I only read so much into that part of the equation.

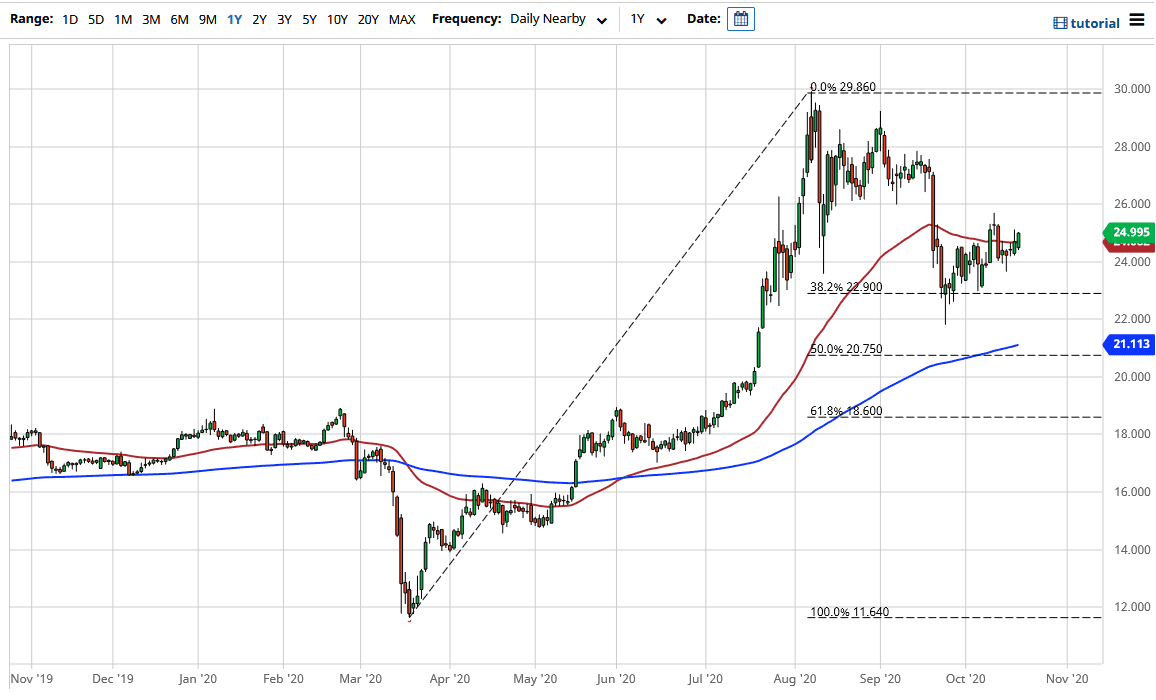

From the technical analysis standpoint, it looks as if the 38.2% Fibonacci retracement level has offered enough support to turn the market around, but ultimately I do think that we eventually go higher anyway, due to the fact that this market is one that has a longer-term cyclical story behind it. Nonetheless, I do think that it is very likely that we continue to see buyers jump in to pick up a bit of value, and I think at this point it is likely that we will continue to see several opportunities that lower levels, including the $24 level, the $22 level, and of course the 200 day EMA. After that, the absolute “floor in the market” is at the $20 level. In other words, I have no interest in shorting this market but that does not necessarily mean that I am jumping in to buy it right away. If we were to break above the $25.70 level, then it opens up a move towards the $27 level.