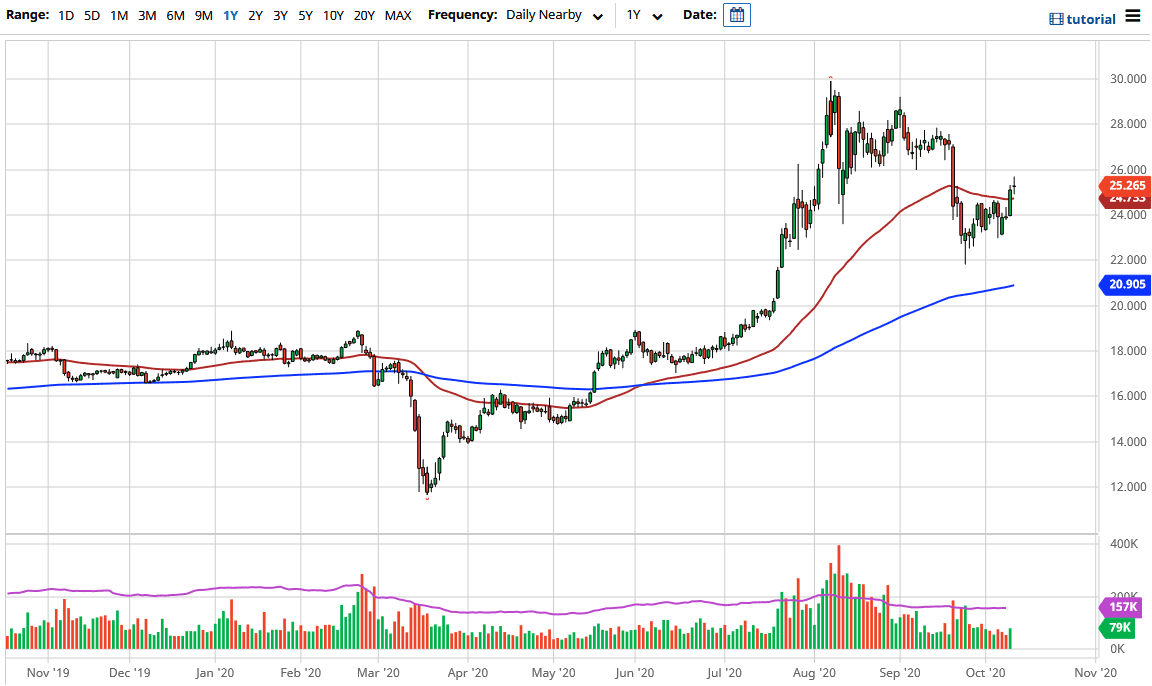

The silver markets initially tried to push higher during the trading session on Monday but gave back quite a bit of the gains in order to form a bit of a shooting star. Looking at the shooting star, that suggests that we are running out of momentum, especially just below the $26 level. The $26 level was previously support, so it could now offer a little bit of resistance. Ultimately, the market is moving back and forth with the US dollar, at least in a negative correlation.

Underneath, the 50 day EMA will of course be important, because it has offered dynamic resistance as of late. I think at this point we are very likely to see this market pullback before we get some type of buying opportunity. The $24 level should be a significant amount of support due to the fact that it is where we blasted off from that region as well. Ultimately, if we can break above the $26 level, then it is likely that we go looking towards the $27 level, which is the area of massive selling that we had recently seen to push this market lower.

Looking at this chart, we have been in an uptrend for some time, but it is going to continue to move back and forth based upon the US Dollar Index. Ultimately, the US Dollar Index tends to move in the opposite direction of the silver markets, as silver of course is priced in that currency. If the US Dollar Index falls, it is likely that the silver market will rally due to that. This is a market that I think will continue to see that correlation play out, and as the thoughts of stimulus continue to be the most important thing out there as far as traders are concerned, it is likely that the silver markets will be moving back and forth due to that. If we were to break down below the $23 level, it is likely that we could go down to the $22 level, possibly even the 200 day EMA. This would obviously be in reaction to the US dollar strengthening. Looking at this chart, I think that we have a lot of noise ahead of us, so short-term back-and-forth trading is probably the best way forward given the fact that the markets have been so noisy.