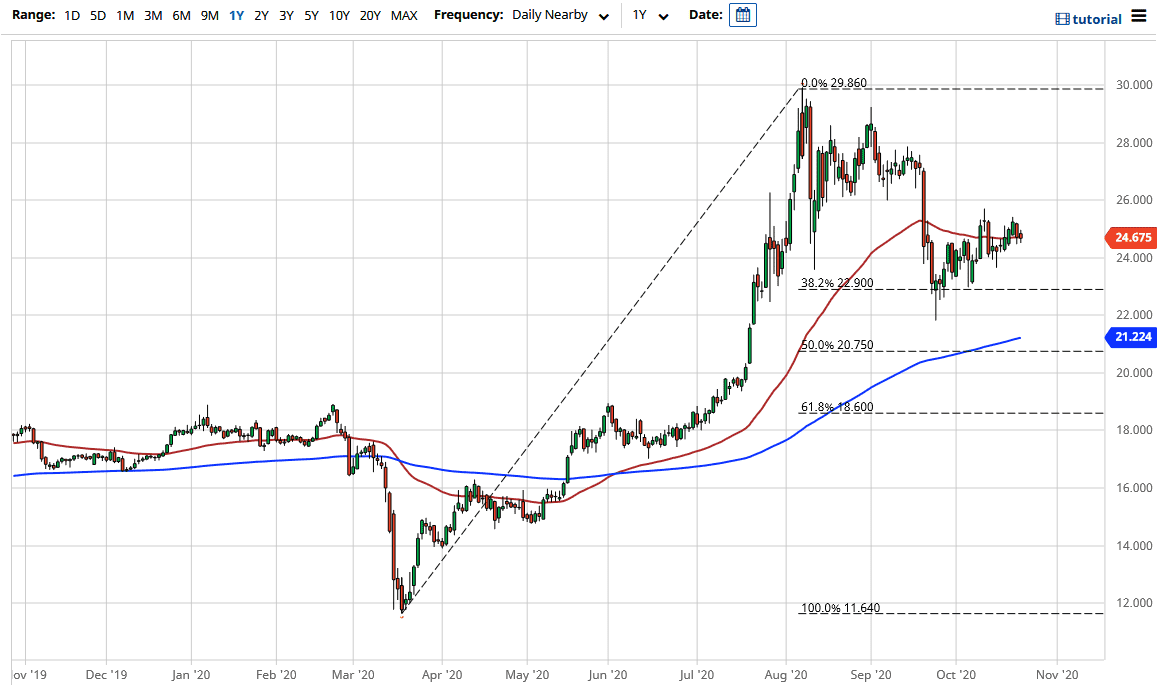

Silver markets have gone back and forth during the trading session on Friday, as we initially tried to rally but gave back the gains early. Later in the day, we have started to recover some of the losses but the most important thing to pay attention to is the fact that we are hanging around the 50 day EMA and simply do not look like we can go anywhere. Looking at the EMA, it is also sideways, so it suggests that we have nowhere to be.

The $25 level above offered some resistance, and it looks likely that we are going to continue to see that $25 level offer a bit of psychological resistance. Ultimately, it looks like we could pull back a bit but at this point I think there are plenty of buyers underneath to keep this market somewhat afloat. I see a couple of different areas of interest underneath that could be looked upon as potential interest, including the $24 level, and the $22 level after that. The 200 day EMA is sitting just above the $21 level, so there are plenty of areas that I think you could be looking for buying opportunities.

That being said, I think that the market probably has a lot of headwinds in the short term, due to the fact that we are still waiting to see whether or not there is going to be stimulus and of course that seems to be going nowhere quick. It is very likely that stimulus will be coming out until we get the election out of the way, and this was even stated by Nancy Pelosi during the Friday session. With that being the case, I like the idea of finding value and I think you will have plenty of opportunities given enough time. In the meantime, I think what you are looking at is an opportunity to buy silver much cheaper if you are patient enough. I would not be a seller, because silver tends to be very volatile and it can work against you very quickly.

The longer-term outlook for silver is still good, because we will eventually get stimulus in the United States which will drive down the US dollar, but we also have to pay attention to several central banks around the world which look to be loosening monetary policy as well. In other words, silver should do good against the multitude of currencies.