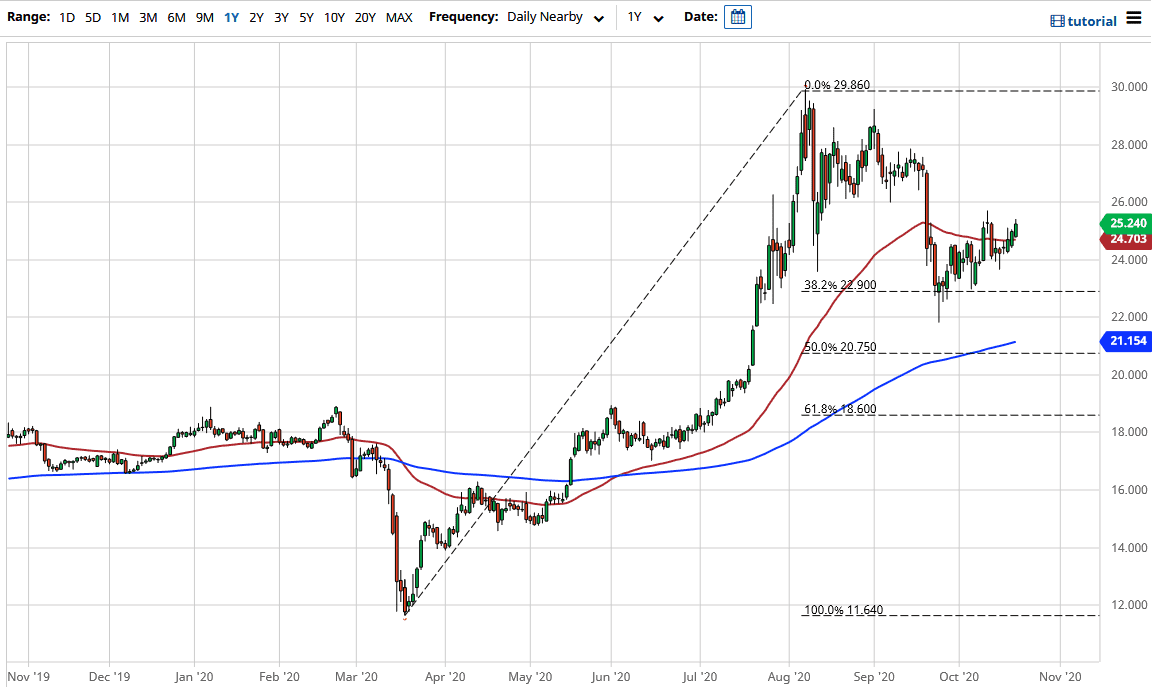

Silver markets have rallied again during the trading session on Wednesday, reaching towards the $25.50 level one point during the day. That being said, we have failed a bit in the sense that we have pulled back some. However, the market looks as if it is trying to break out from significant resistance, and at this point, it is probably only a matter of time before we get some type of move higher.

Having said that, we are currently waiting to see whether or not we get a stimulus coming out of the United States, as the children in Congress continue to bicker about whether or not something can be done before the election. There is the possibility that we get a surge in the US dollar due to something like that falling apart, but in the end, there is still a lot of stimulus coming given enough time. At this point, it is really only a question of when not if. Precious metals should continue to find a certain amount of pressure to the upside and silver will be right there with gold, although silver also has to worry about industrial demand.

There is a theory out there that stimulus will drive up demand for industrial metals, but the reality is that this will be the fourth stimulus that we have had in the last two years, and it has not driven of demand. At this point, it is going to be about fiat currency depreciation more than anything else, so it is difficult to imagine a scenario where suddenly silver is highly sought after for any other reason. If that is going to be the attitude of the market, gold should fare better in general. Remember, silver is a thinner contract, so it tends to make more erratic moves.

To the downside, I see the $24 level as support, just as I see the $22 level and the 200 day EMA all offer nice buying opportunities. To the upside, the $26 level is obviously resistant, followed by $27. I think we continue to grind more than anything else, but I still would not be a seller of silver, simply because I believe in the longer-term move to the upside due to not only the Federal Reserve, the United States Congress, but other central banks around the world also looking to flood the markets with liquidity.