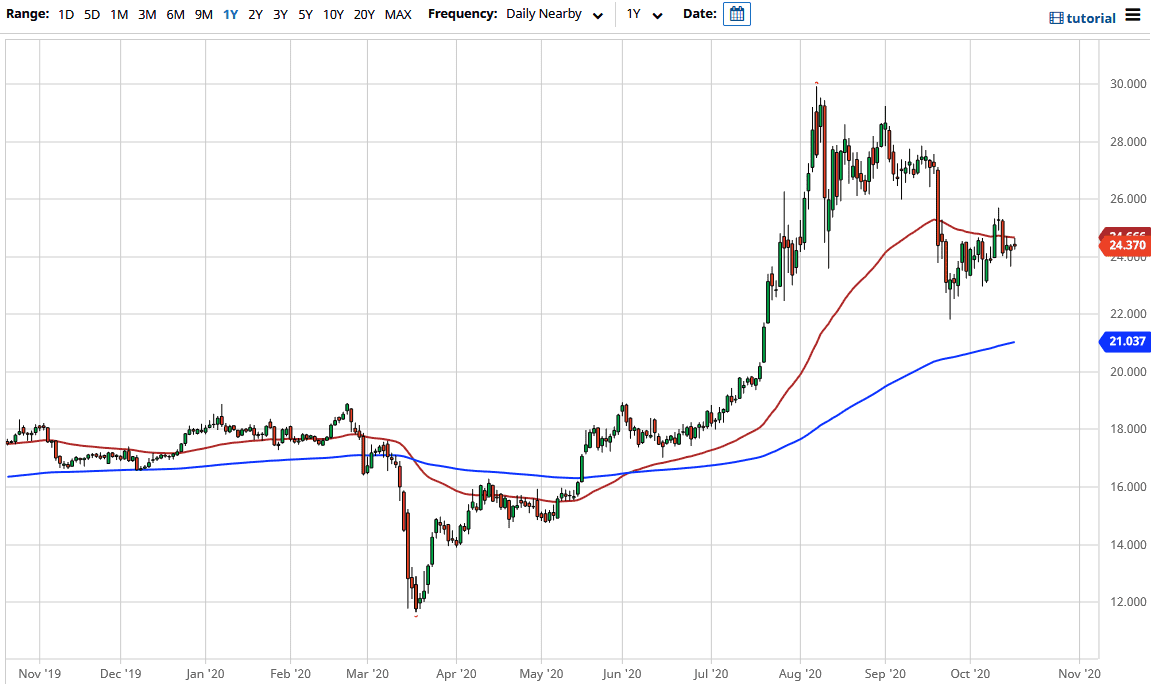

The silver markets have rallied a bit during the trading session on Friday but gave back the gains to show less than convincing momentum. At this point, the candlestick reached towards the 50 day EMA before pulling back, and it now looks as if we will continue to go back and forth because of the proceeding hammer. That being said, the 50 day EMA does offer a bit of psychological support and resistance, so perhaps pulling back from here could make the most sense. Regardless, this is a market that I see no interest in selling for any significant move, and it is very difficult to imagine a scenario where I would suddenly do that.

All that being said, the US Dollar Index will continue to be a major influence on this market, so you should pay attention to what is going on with the greenback. It is essentially running at a -0.9 correlation, meaning that it is almost perfect in its opposite polarity. If the US dollar starts to fall, that does put a little bit of demand for silver, as it is a way to protect wealth. However, it looks as if there are enough concerns out there, maybe about the stimulus, that the US dollar should continue to strengthen a bit.

The silver market will probably continue to be lifted due to the central banks around the world loosening monetary policy and the almost certain stimulus that is coming after the presidential election in the United States. Because it is can it take some time to get that stimulus, I do think that it is likely that we drift lower. However, from a supercycle perspective, silver is still very bullish, and I think it is only a matter of time before value hunters get back into the market. The 200 day EMA is currently sitting at the $21 level, and I believe that the $20 level is essentially the “bottom of the market.” If we broke down through there, then it would be a complete collapse in confidence. At this point, every $1.00 move to the downside is an opportunity for potential buying, but I would not jump into a market like this with both feet, rather I would like the idea of picking up little bits and pieces of value in holding on to what I think will most certainly be a longer-term big move. The $27 level above has been massive supply, so I think it makes for a nice target, especially as soon as we see the US dollar rollover.