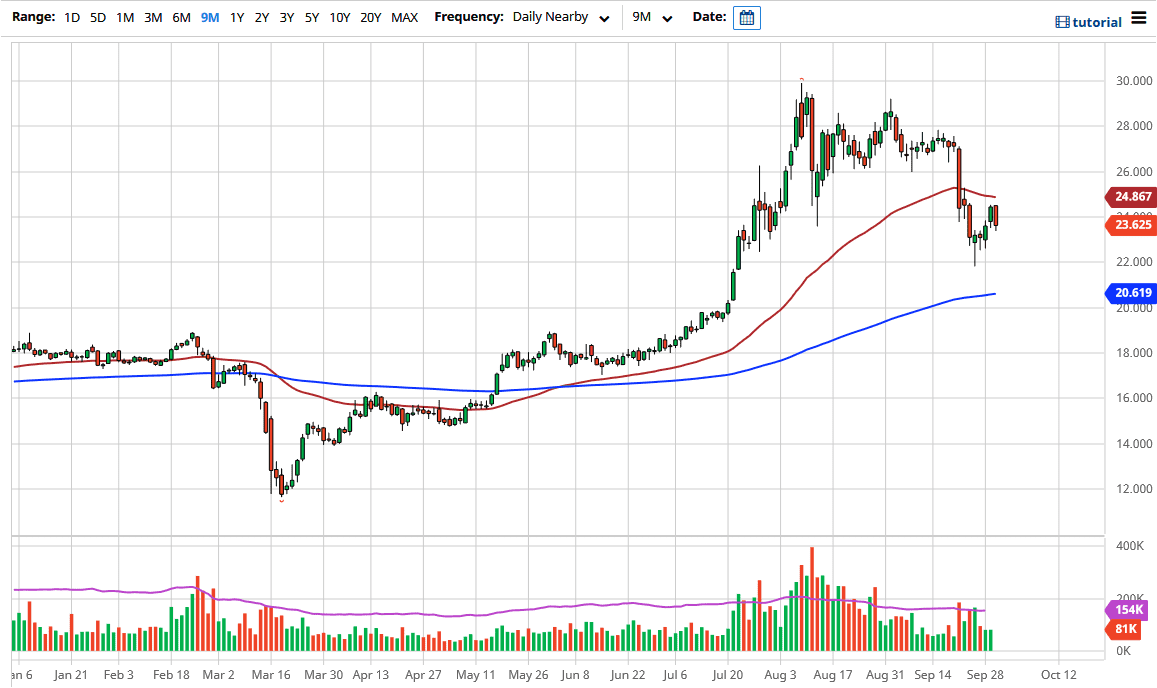

The silver markets fell significantly during the trading session on Wednesday, which is a bit telling considering that the US dollar also fell. That being said, this is a market that is showing signs of divergence. All things being equal, the US dollar falling should lift silver, but we saw the exact opposite during the trading session. This could suggest that silver is significantly softer right now, and it could send the market lower.

To the upside, the 50 day EMA could offer a bit of resistance, so I think that it is only a matter of time before exhaustion would come into play. With that being the case, I believe that the market has plenty of support underneath though, and it is likely that we will probably pull back in order to find more support. I believe that the $22 level underneath was a significant area of support and it is likely that we will see buyers jump in sooner or later. However, I would not be overly surprised if we broke down below the $22 level, reaching down towards the $200 level, maybe even the $20 level.

With this, I am looking for opportunities to pick up silver “on the cheap”, and I think that the volatility will be a major problem going forward. Keep in mind that the silver market tends to be much more volatile than gold, so do not expect it to act the same. In fact, when the precious metals market selloff, you want to sell silver because it moves so quickly. However, if precious metals, in general, are rising, the volatility can make silver a little bit more difficult to hang onto in comparison to gold. I like the idea of silver going higher but keep an eye on your leverage as the futures market will be a very dangerous place to be. However, if you can trade the CFD market, you can see a much more reasonable position based upon scaling down. I think that maybe buying some type of pullback that shows signs of stability, and then adding more if the trade goes in your direction. If we break down below the $20.00 level, that would be crucial information as it would show that silver is going to fall apart. Longer-term, I believe that we get back to the $28 level, but we have to build a bit of confidence between now and then.