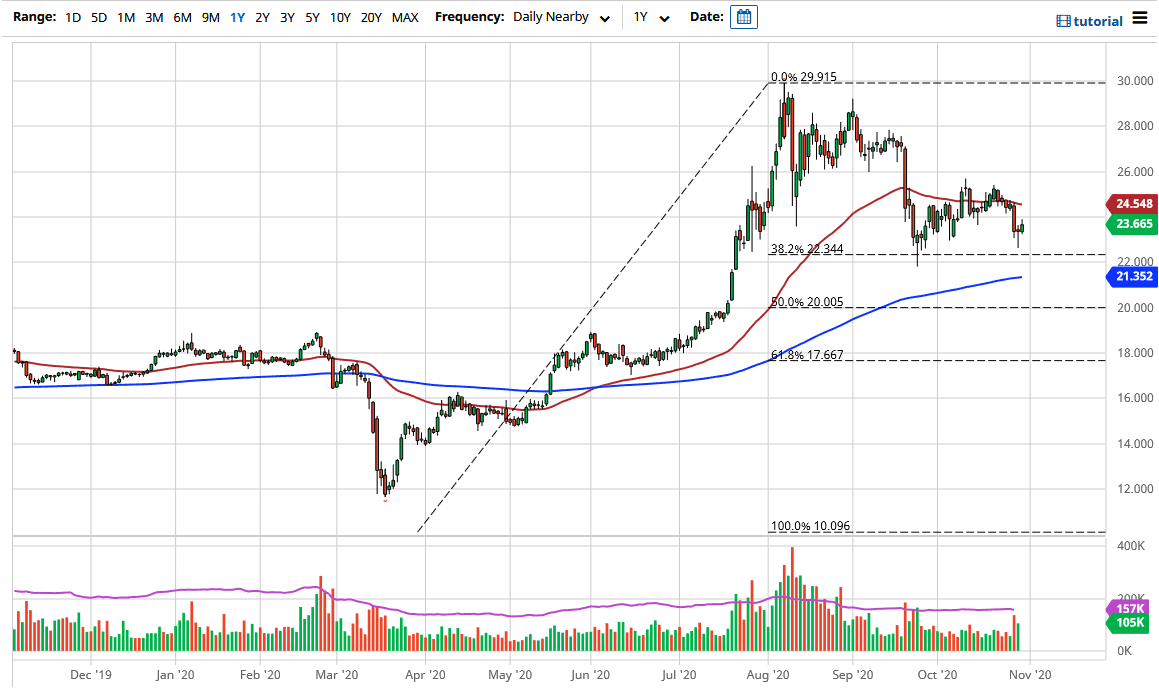

The silver markets have rallied a bit during the trading session on Thursday, reaching towards the $24 level. However, the market is still very skittish right now, and of course with the US dollar going back and forth the way it has, it will have a lot of influence on this market. The candlestick from the Wednesday session was a very negative, and the fact that we could not reach towards the top of it suggests to me that we still have some negativity ahead. Furthermore, we need to pay attention to the fact that the markets are going to continue to see a lot of volatility and therefore silver is going to be particularly dangerous.

Remember that the silver market is based on a much larger contract than gold, so it does turn much quicker than gold, and then can also cause a significant amount of damage to your account if you do not get it quite right. At this point, the market is likely to see a lot of noise towards the 50 day EMA above, closer to the $24.83 level. Underneath, the $22 level is supportive so it is worth paying attention to, so I do believe that it is an area where buyers might come back. Looking at the candlestick for the day, it does suggest that there are most certainly buyers underneath.

Underneath the $22 level, the market is likely to go looking towards the 200 day EMA closer to the $20.65 level, which of course sits just above the psychologically and structurally important $20 level. This is a market that I think will continue to show a lot of noise, but I do think there is plenty of demand underneath. Currently, we are paying attention to central banks around the world that are looking to loosen monetary policy, and then of course the fact that there is a lot of fear out there. On the other side of the equation is the fact that the market is likely to have to look at the potential of demand for silver as it is an industrial metal. If you are playing the safety trade, you are much better off in the gold market than silver. However, when I look at this chart it still looks very much in an uptrend, but we may have a little bit more of a move lower before massive demand comes into play.