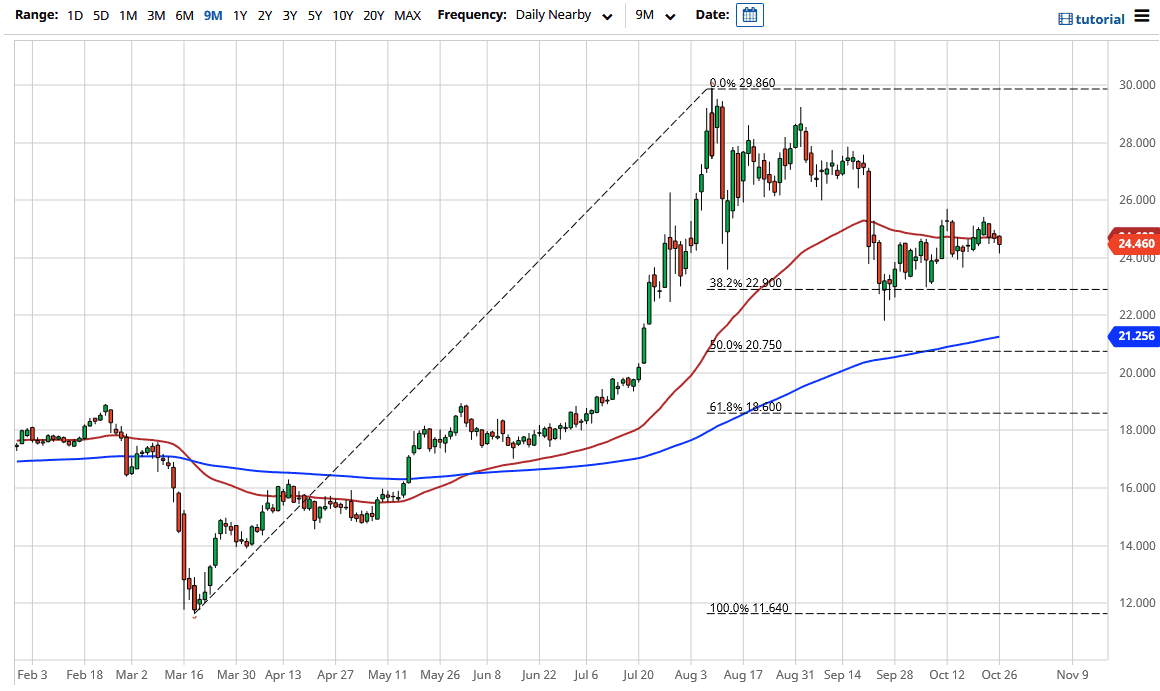

The market has broken through the 50 day EMA quite easily, and then reached towards the $24.25 level. At this point in time, the market looks as if it is ready to go much lower, so I think it is only a matter of time before we drop towards support levels underneath. The real question at this point is which one of the potential support levels underneath that we should be buying at?

Looking at the overall attitude of the market, I believe that the $24 level is rather crucial, but we also have the $23 level, $22 level, and then the 200 day EMA. This is a market that we will be more than likely pulling back, but you need to see the US dollar give up some of the gains in order to do that. The 200 day EMA currently sits at the $21.25 level, which is an area that I think a lot of people will be paying attention to. Ultimately though, the market is to be highly influenced by the US dollar sell so I will be watching the US Dollar Index, trading in the opposite direction.

All things being equal, this is a market that will continue to be very noisy, and as a result I think that you will get an opportunity to pick up silver at a cheaper price, and the Monday candlestick could be the first sign that we are finally going to pull back and drop. If that is the case, I will be looking for an opportunity to take advantage of supportive action underneath, but I will do it based upon a daily candlestick, not some short-term candlestick because silver is very volatile to say the least, and in the current scenario that we find ourselves in right now, it is probably going to be even more so. Because of this, I think you need to be very cautious about putting money in this market right away and hand over fist, but I do think that ultimately, we will get a nice buying opportunity. The market is one that you need to be very patient with, because once it does finally make a move, he tends to make a huge one. Silver is something that you typically invest in, not scalp.