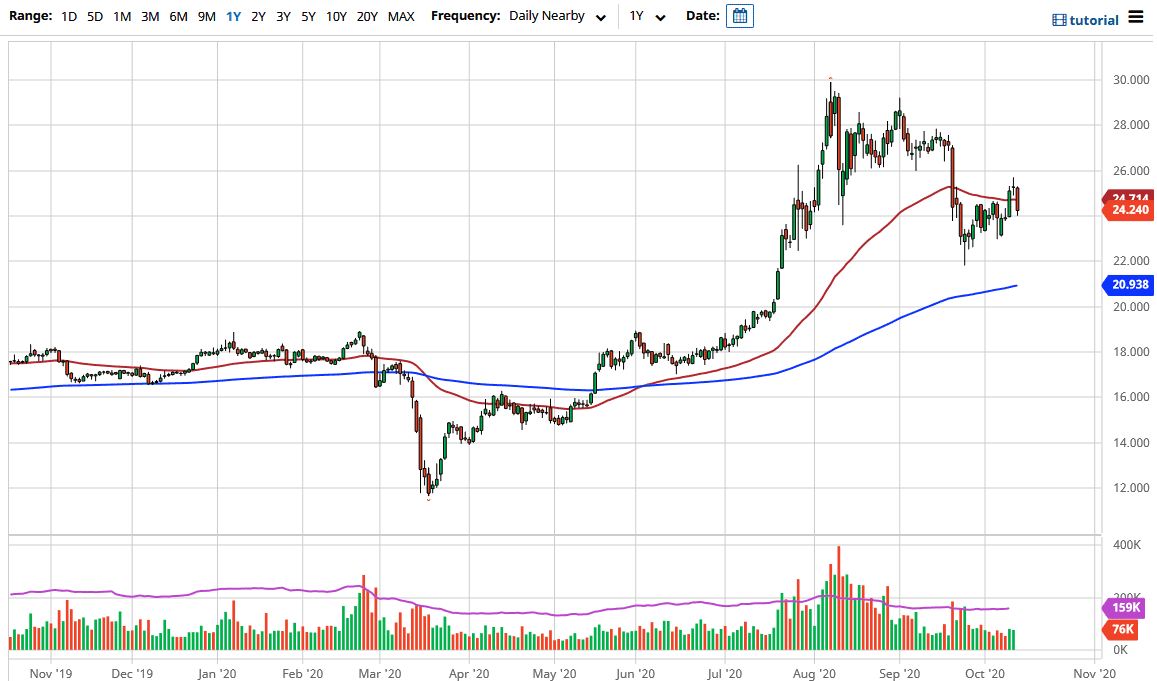

The silver market has broken below the 50 day EMA on Tuesday, showing signs of weakness. Ultimately, this is a market that reached all the way down to the $24 level, which is an area that has been important more than once. Ultimately, this is a market that continues to be very choppy so it will be interesting to see how this plays out. Longer-term, the market has been in a bullish run, so I think that the buyers will return given enough time. After all, the central banks around the world continue to see the need to boost the market with liquidity and other words driving down the value of fiat currencies. This has a knock-on effect of driving commodities higher.

A lot of traders will jump into precious metals in order to get away from the destruction of wealth, so it is only a matter of time before buyers get involved. The $24 level has been important more than once, as we bounced from there a couple of times on short-term charts, and I think that if we break down below the $24 level it is likely we go looking towards the $23 level underneath where we had bounced from previously.

All things being equal, the market could go all the way down to the $20 level, which is the scene of the major breakout. The $20 level is essentially the “floor” in the market. Looking at this, I believe that some type of supportive candlestick should present itself that buyers will take advantage of based upon “value.” I think that given enough time we should see plenty of opportunities to go higher, based upon what is a cyclical trade. I would not jump into this market with both feet and therefore enter slowly. To the upside, I believe that the $27 level will be a massive supply area that will be difficult to get above, but if we were to break above there it is likely that we go looking towards the $20 level, possibly even as high as the $30 level. All things being equal, be very cautious because it looks as if the US dollar is trying to recover a bit. I do believe that we should get an opportunity to pick up silver at lower levels, but we may have a couple of days before we can do that.