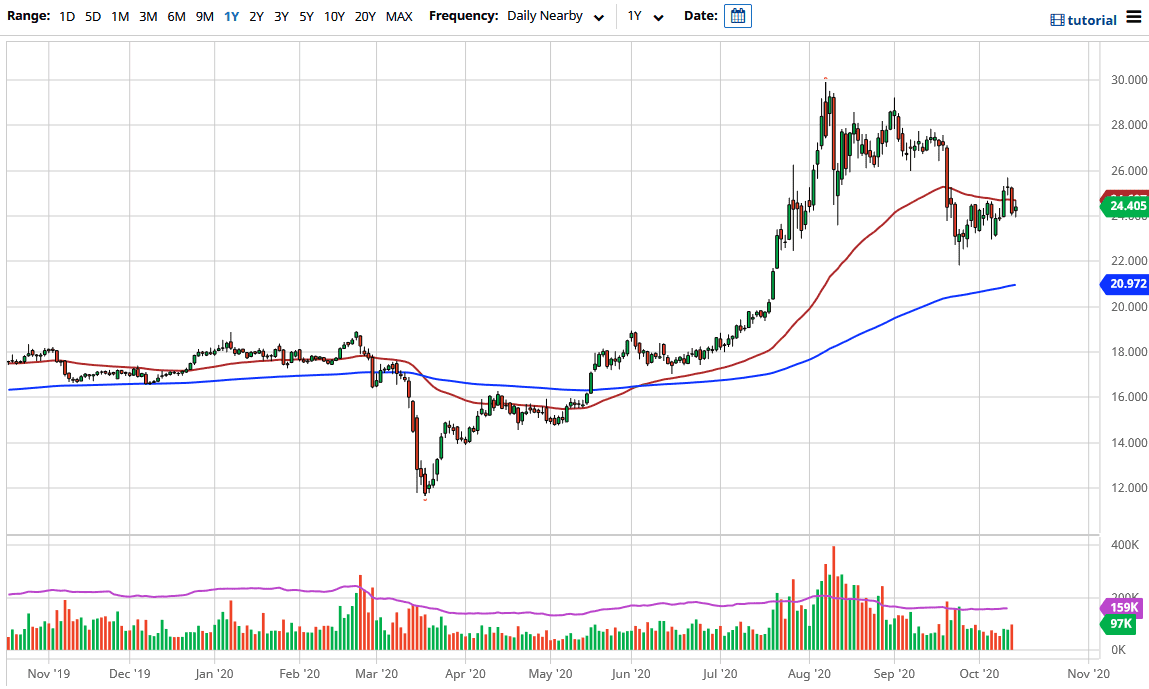

Silver markets have gone back and forth during the trading session on Wednesday, as we continue to dance around the $24 level underneath, and the $50 level above. In fact, that was the range that the market had spent most of the day and during the day on Wednesday, so it looks as if we are continuing to see a lot of confusion.

The silver markets have struggled a bit for clarity, but at this point in time the 50 day EMA is an indicator that a lot of people have been paying attention to, and it does in fact look like we may pull back from here. The US dollar strengthening works against the value of silver in general, as the commodity is priced in that greenback. At this point, the market is likely to continue to move based upon the idea of whether or not the dollar rises or falls, and whether or not there is a stimulus. The stimulus is the biggest driving force for the US dollar right now, and with that in mind, it makes quite a bit of sense that we will continue to see the stimulus talks have massive effects on this market. I think at this point in time it looks like we are ready to go lower, and if it does then I think there are multiple areas where we could find plenty of buying opportunities.

The first area is the $24 level, but then after that, we have the $23 level followed by the $22 level. The 200 day EMA sits underneath there, perhaps reaching down towards the $20 level. It is the $20 level that is the “floor” in the market. I think at this point it is only a matter of time before we get buyers, and this market is rather noisy so I would be cautious about jumping in right away, because quite frankly this is a market that is very dangerous at times, and the volatility in this market is very dangerous. Because of this, you need to build up positions very slowly. I still believe in the longer-term uptrend in the silver market, but that does not mean that we cannot continue to drop in the short term as the US dollar gets a bid due to the fact that there is so much concern out there right now.