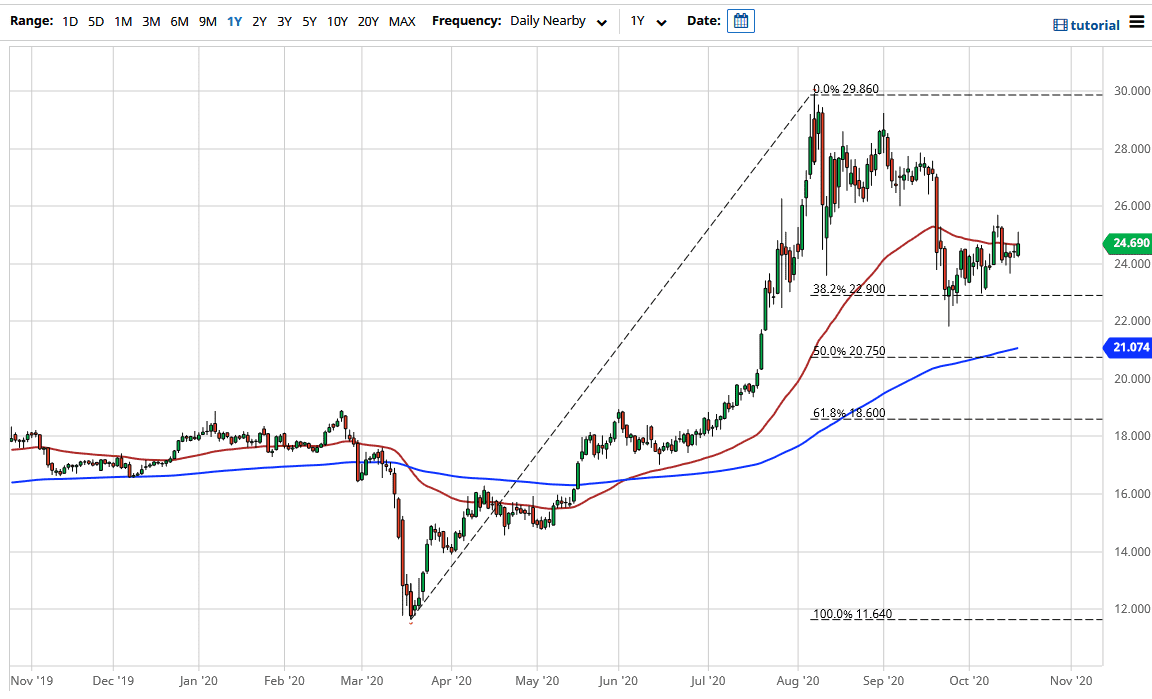

Silver markets have rallied a bit during the trading session on Monday, breaking above the 50 day EMA as we continue to see a lot of momentum jumping into the marketplace. Ultimately, this is a market that I think continues to see a lot of interest, because if for no other reason central banks around the world are trying to do everything, they can loosen monetary policy, and pump the markets full of the stimulus. Having said all of that, the markets are going to go back and forth due to the fact that the stimulus situation in the United States is so fluid. After all, if we get a significant amount of stimulus, that will drive down the value of the US dollar in general, which drives up the value of commodities.

The shape of the candlestick is a bit concerning in the sense that it shows we cannot hang on to the top of the range. The market has broken above the $25 level but only to give those back. At this point, it suggests that we are going to reach down towards the $24 level underneath. If we can break down below that level, then it is likely that we go looking towards the $22 level after that. The 200 day EMA underneath is very likely to be important as well, and then needless to say the $20 level, the scene of the last major breakout, would be an area that a lot of buyers will be interested in jumping on board.

I have no interest in shorting this market, even though I fully anticipate that we are going to break down from here. If we were to break above the top of the candlestick for the trading session on Monday, then it is likely that we would test the $26 region. That is an area that has brought in some selling pressure, and I think at this point it is going to be difficult to overcome anyway, due to the fact that stimulus is more than likely coming later than originally anticipated, meaning that we could see a bit of US dollar strength. If the US dollar strengthens, that works against the value of silver but eventually, both can go higher in a bit of a safety play. The initial move though is almost always that precious metals get sold into.