The silver markets have gone back and forth during the trading session on Thursday, as we continue to see the markets look for solutions to whether or not we are going to get some type of stimulus in the United States. This would of course offer a cheaper US dollar in theory, and as a result is very likely that we would see silver gain due to the fact that the currency would be falling. Also, there is the theory at least that there could be a bit of an increase in demand for silver, as it is an industrial metal. However, we have had three stimulus packages previously, and the economy is still struggling.

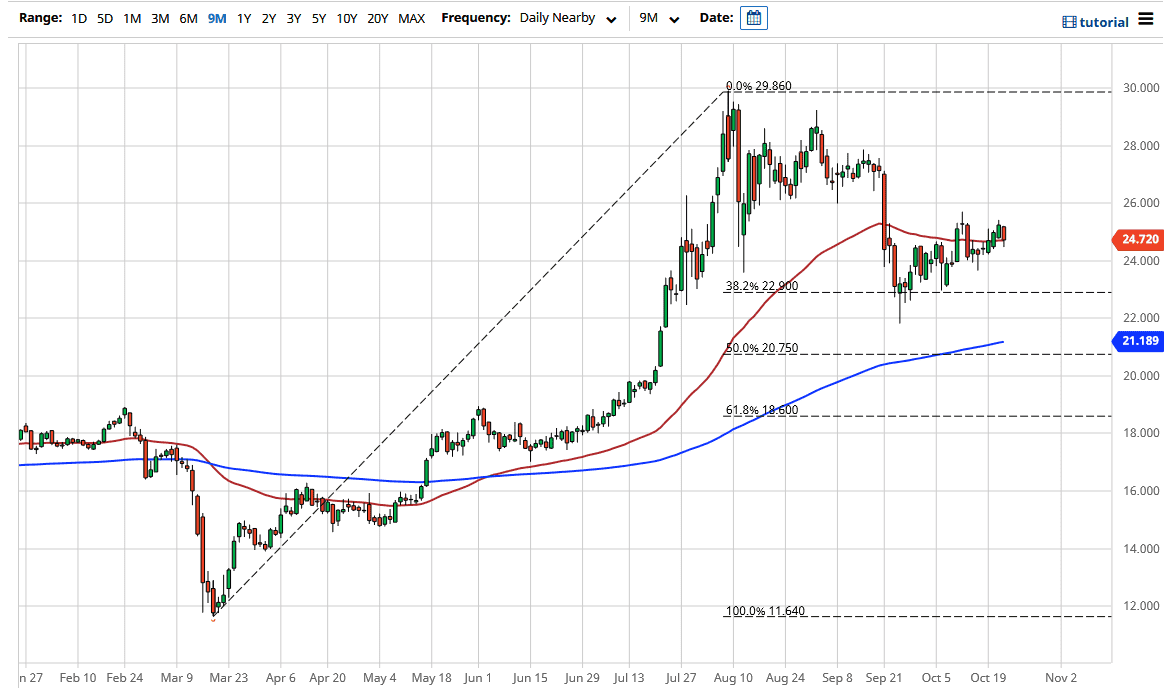

Looking at this chart, the 50 day EMA of course has offered some attention and support, but ultimately it is likely that we could break down below there and go looking towards the $24 level, possibly near the $22 level after that. Underneath that, the 200 day EMA offers support and I think that longer-term trade will favor the upside in general, as the US dollar will probably struggle due to massive stimulus. Furthermore, silver also gets a boost due to other central banks around the world doing everything they can to flood the markets with liquidity.

Having said that, silver is going to lag gold. What I mean by this is that silver is also an industrial metal, unlike gold. Gold markets tend to do much better as a way to fight off the possibility of currency being devalued, so that is something that you may want to pay attention to. Nonetheless, the two markets do tend to move in the same general direction. My attitude with silver is that it is a market that you should be buying on short-term dips, and certainly have no interest in shorting anytime soon as I think central banks will do everything, they can to try to reinflate the bubble. This is not to say that there is a bubble in silver, rather there is a massive bubble in risk assets in general. Traders will try to buy hard assets in order to protect wealth, and silver will be a beneficiary of this. If we can break above the shooting star from last week, then it opens up the possibility of a move towards the $27 level where there should be significant resistance.