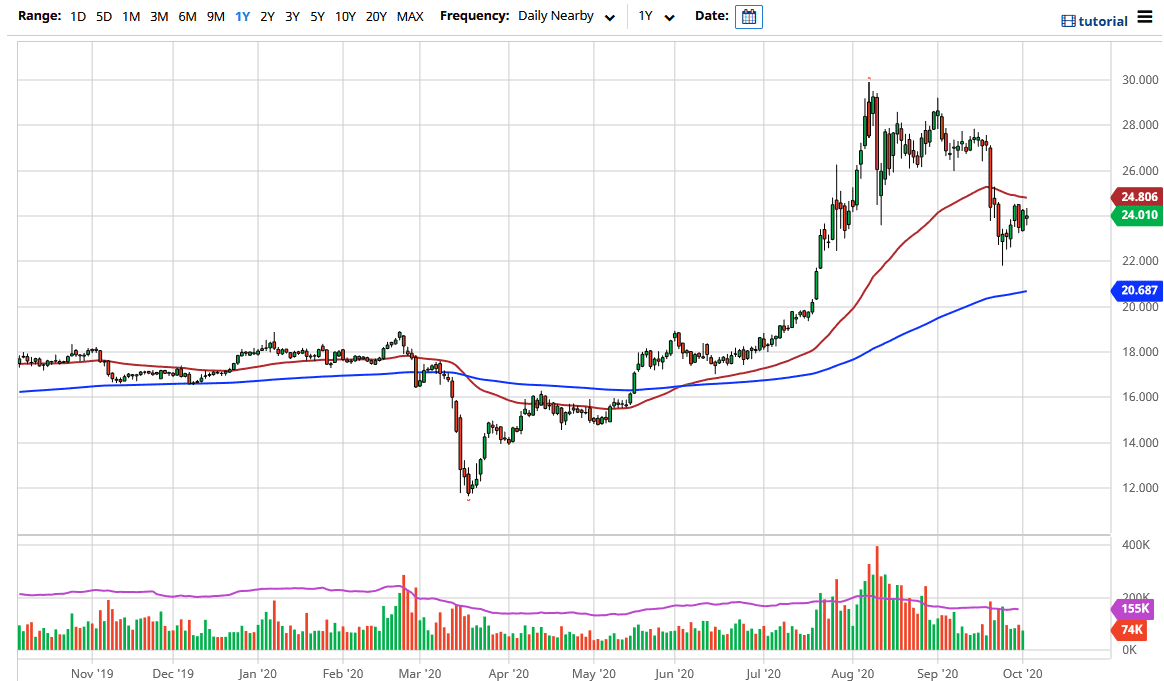

Silver markets have gone back and forth during the trading session on Friday, as we cannot quite decide what to do with the $24 level. Furthermore, we have to pay attention to the 50 day EMA just above, which currently seems to be offering significant resistance. Because of this, we are compressing, and it looks like we could get a bit of a move rather soon. Having said all of that, you could make an argument at this point some type of symmetric triangle, but more than anything else I think you need to pay attention to the US dollar.

Looking at the US dollar, it looks as if it is trying to strengthen a bit and that is actually bad news for silver. Having said that, I believe that the silver markets more than likely pullback towards the $22 level, where we would find plenty of short-term support. I find even more support closer to the 200 day EMA and the $20 level underneath, which I think is ultimately much more supportive from a longer-term standpoint as it was the scene of a major breakout.

At this point in time, it is likely that the $20 level will determine whether or not we are still in an uptrend. We could have a pullback all the way to that level and still be very strong over the long term because we had gotten far ahead of ourselves. The biggest problem with silver is that it is not as much of a safety trade as gold is, because silver has that major industrial component that core would suffer in the current environment. With that being the case, I think that it is only a matter of time before we see some type of bigger move, and I recognize that if we were to close above the 50 day EMA on the daily chart then it is likely that we could go looking towards the $27 level. I do not expect that to happen, but I have to keep my mind open to both potential moves, but at this point, the thing that I would stress is that I am not looking to short the market. Instead, I am looking to find value at lower levels because I believe in the long-term efficacy of an uptrend when it comes to precious metals in general.