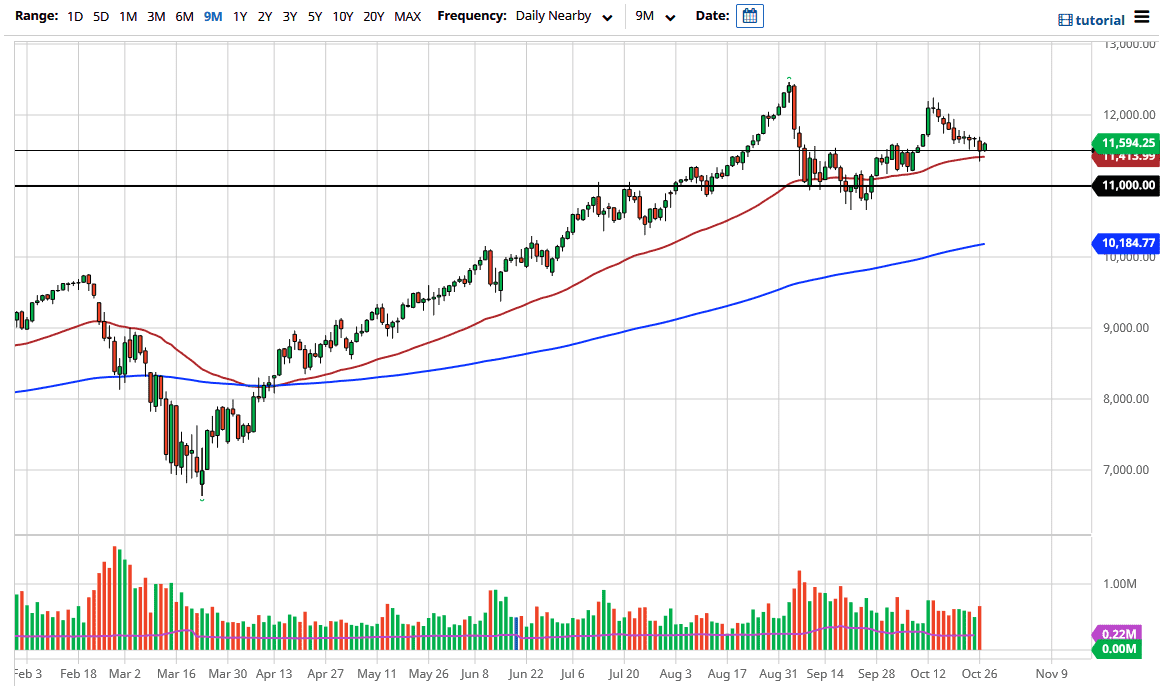

50 day EMA is just below there, and of course the fact that we formed a bit of a hammer during the previous session but had broken down the previous couple of hammers suggest just how noisy this market is going to be. Given enough time, I do think that the buyers return because these stocks that lead the NASDAQ 100 higher and lower are the ones that everybody on Wall Street continues to buy. We are now starting to look at the “work from home trade” coming back into vogue. Furthermore, we are starting to pay attention to the fact that stimulus could be coming, so that of course is something that we should be paying attention to as well.

Underneath the current trading environment, there is support extending all the way down to the 11,000 handle. At this point, I think it is only a matter of time before the buyers return so I am simply looking for buying opportunities. We probably have more noise in this general vicinity than anything else, and of course with the election coming there is going to be significant volatility. If we can get past that, then Wall Street is very likely to celebrate with the idea of certainty, and perhaps stimulus. Stimulus of course will be a short-term rush, as it typically is.

The real question is whether or not we can continue to go higher? I do not know that we cannot, but I am certainly not going to be a seller of the NASDAQ 100 until something changes drastically, and from what I mean by that, I am talking about a major structural difference. Buying pullbacks has worked for quite some time, but one thing that is worth noting is that this was the first day in almost 2 weeks of the NASDAQ 100 started to see buying pressure and closed in the green. That in and of itself could be a signal, but really at this point in time I think you need to find dips for short-term buying opportunities more than anything else. Again, I have absolutely no interest in trying to short this market, that has been a great way to lose money for several years.