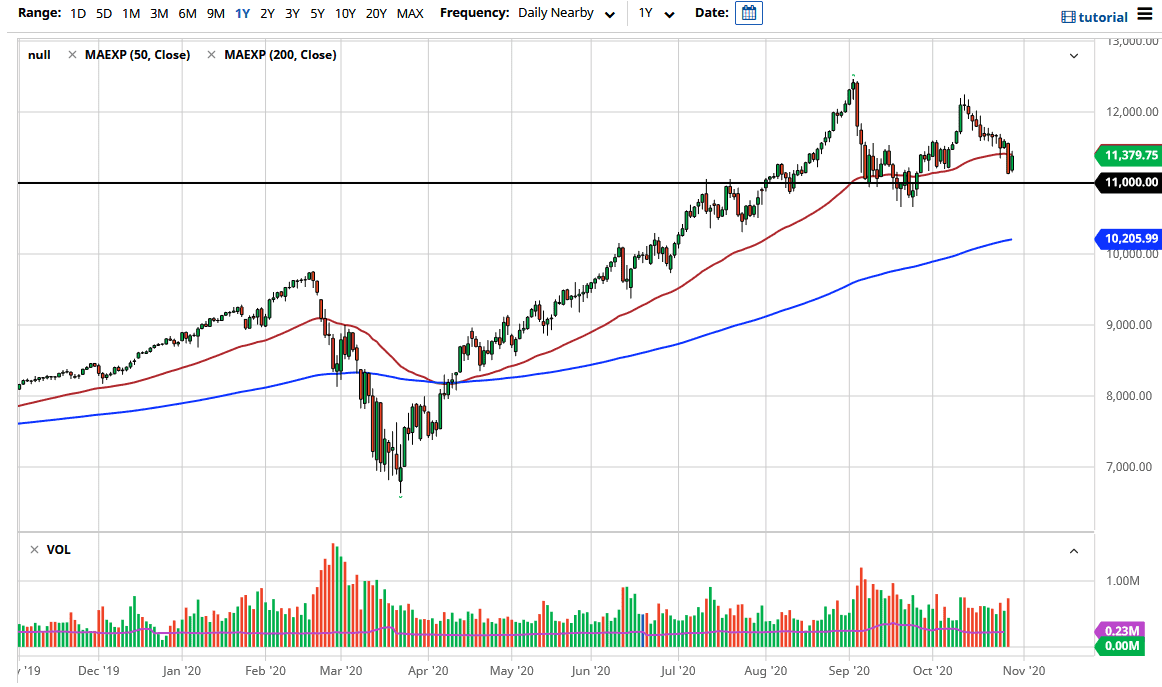

The NASDAQ 100 has rallied a bit during the trading session on Thursday, reaching towards the 50 day EMA. That is an area that is important, but we did not wipe out all of the losses from the previous session on Wednesday. If we can do that, this market will more than likely go looking towards the 12,000 level, possibly even further than that.

Looking at the candlestick, it is bullish, but we still have enough pressure above that I think we are probably going to remain somewhat range bound. It looks as if the 11,000 level will continue to be supportive, and I think that extends down to the 10,600 level. It is not until we break down below there that I would be a bit concerned about the NASDAQ 100, but let us be honest here: big tech is going through a lot of grilling by the U.S. Congress, and the fact that the NASDAQ 100 is at least trying to hold up is a good sign.

At this point, I do believe that we are trying to find some type of supportive action, but we need good news to make that happen. There has been a few decent headlines overnight about coronavirus treatments, and that is one of the big things that will possibly shoot this market to the upside. Furthermore, we have the European Union locking itself down to one extent or another, so that could continue to drive money into the US indices anyway. I do like the idea of buying dips in this market, but I recognize that you need to be cautious about jumping “all in”, as there are so many moving pieces out there that will move the markets. Stimulus is a long way away, and of course the election is something that is a major possible problem.

All things been equal though, I do not like shorting indices, and the “double top” has not been confirmed anyway, at least not until we break down below the lows for the month of September. As long as we do not, I think we remain range bound in the NASDAQ 100 just as we are in the S&P 500. Ultimately, this is a market that I think will continue to be very noisy so regardless of which you do you need to keep your position size reasonable.