As Wall Street does the mental gymnastics necessary to come up with a reason for stimulus to appear, we continue to see buyers jump in and pick up stocks. The NASDAQ 100 of course benefited from the usual suspects, as Facebook, Microsoft, Alphabet, Netflix, and Apple all had plenty of buyers based upon the idea of the market being re-inflated with stimulus and of course the economy certainly taking off straight up in the air.

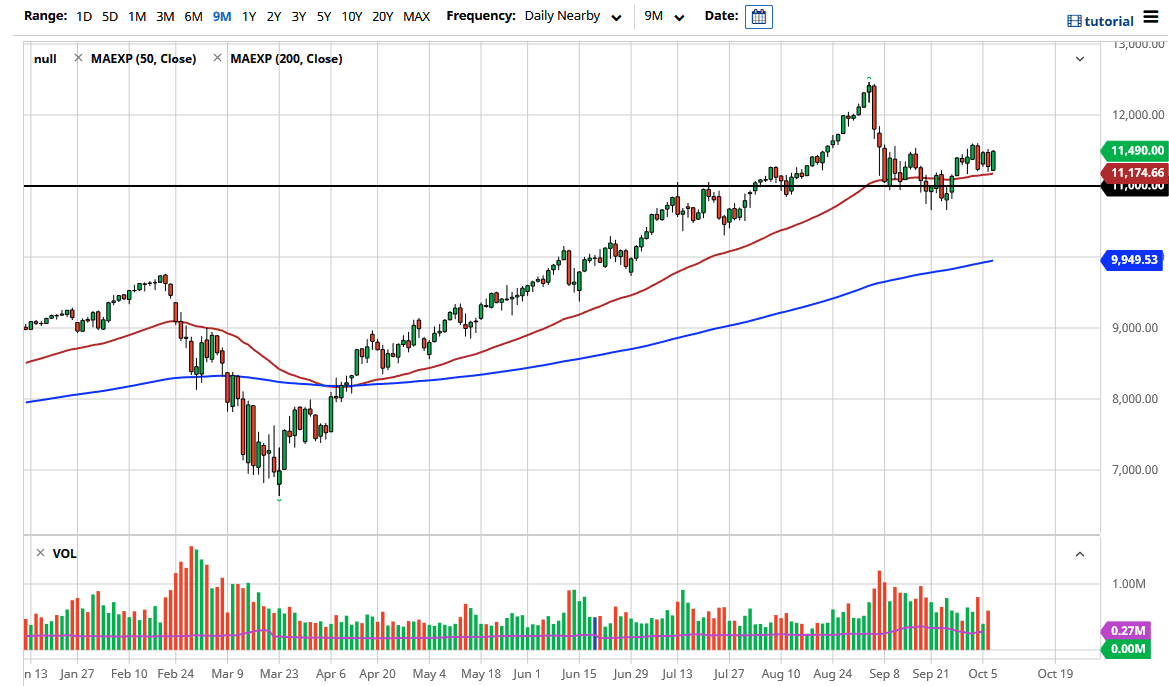

The 50 day EMA underneath is significant support based upon what we have seen over the last week or so, and of course a lot of technical traders will pay close attention to. Because of this, we will continue to see not only buyers in this area, but possibly just below there based upon the fact that the 11,000 level is just underneath. I believe at this point in time we are looking at a market that is trying to find any reason whatsoever to rally, so therefore I suspect that it is much easier to buy this market than it is to sell it. However, the recent highs near the 11,550 level will be difficult to break out, but it does open up the possibility of a move to the 12,000 handle. All things being equal though, I think the 12,000 level will only be a psychological barrier, meaning that we will more than likely continue towards the all-time highs if we do that. At this point, it is going to come down to whether or not we get stimulus. If we get some type of stimulus, that will probably have Wall Street buying everything it can.

However, if US politicians continue to act like children, as they typically do, that could cause a lot of uncertainty in the market. Furthermore, we have the election coming in the next month, so I suspect that the only thing you can probably count on is a lot of choppiness when it comes to the indices in the United States. Having said all of that, the reality is that the NASDAQ 100 is built to go higher, not lower as it is not equally weighted and favors all of the household names.