The NASDAQ 100 has broken out during the trading session on Friday as stimulus continues to be a major factor when it comes to markets. Ultimately, the market has finally cleared the resistance that we have been forming for some time, and now we have formed a “V bottom”, signifying that we are ready to go much higher. The market looks set to go back to the all-time highs because it is the only thing left to do now that we are back to trading on “pure hope.”

The market will continue to be based upon the entirety of stimulus more than anything else, and any idea of growth or earnings pushing the markets higher is quite a bit of a stretch at this point, as markets have only moved on liquidity more than anything else over the last decade or so. The NASDAQ 100 is not built to fall, as it is heavily weighted towards the stocks that everybody loves to own, so unless that handful of Wall Street darlings falls, the NASDAQ 100 by extension cannot fall for any great time.

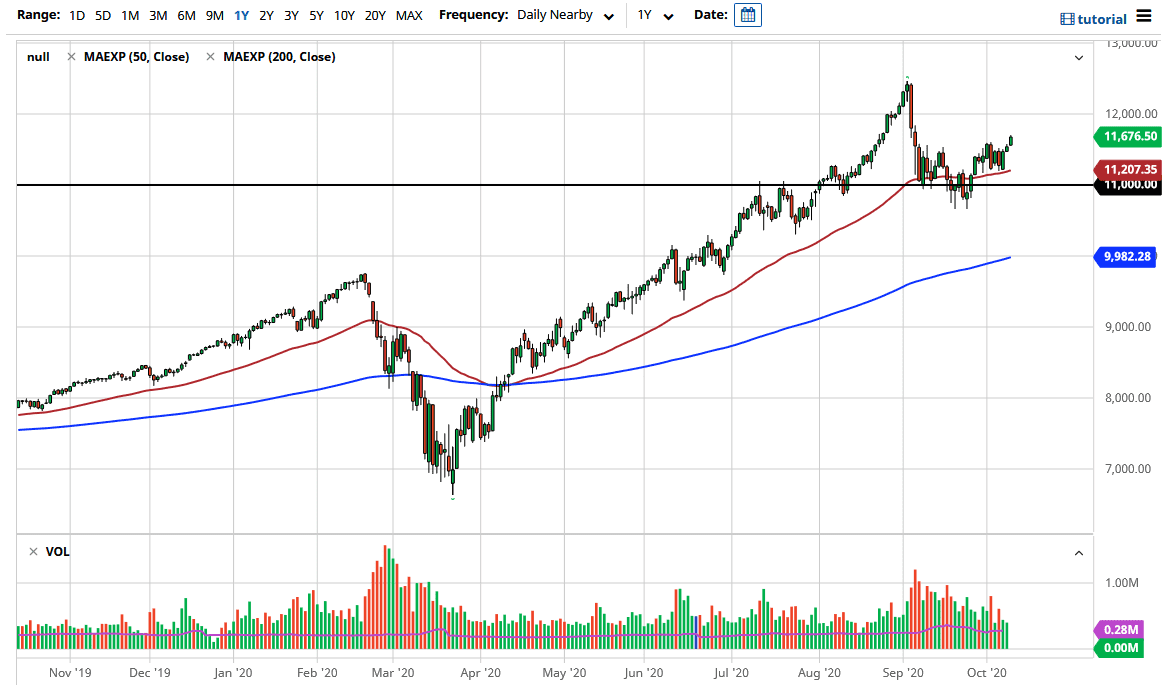

Underneath, we have the 50 day EMA offering support, just as we have the 11,000 level. The market looks likely to see a lot of noise in general, but that noise will be opportunities to pick up bits and pieces of value on dips, and I think that eventually we will see this market race to the highs based upon the fact that it is with the trend, and Wall Street will be celebrating the idea of cheap money. Beyond that, we also have the idea that stimulus will somehow drive demand higher, but when you look back at the last three attempts, they have not worked. Regardless, it seems very unlikely that at least in the beginning we will not see some type of attempt to get to the highs. I have no interest in shorting this market, and in fact, in the last few years, I have learned not to short US indices in general because it simply does not pay. Markets are not free markets anymore; the Federal Reserve intervenes so you might as well take advantage of how they are designed to move. It’s simply a matter of buying on the dips, holding, or being on the sidelines.