The price of gold rose to $1930 an ounce, its highest level in three weeks. Last Friday's trading session was the best daily performance for the yellow metal since the end of August trading. The dollar's weakness amid hopes of stimulus and data showing a significant growth in Chinese service sector activity in September, helped lift the price of the precious metal. During last week’s trading, gold prices rose by about 1%. Silver futures rose to settle at $25.108 an ounce, while copper futures settled at $3.0825 a pound.

According to reports supporting recent market moves, White House Economic Adviser Larry Kudlow said that US President Donald Trump has approved a revised stimulus package. Kate Davidson of the Wall Street Journal tweeted that US Treasury Secretary Stephen Mnuchin will present House Speaker Nancy Pelosi a counter-offer of $1.8 trillion for the Democrats' $ 2.2 trillion plan.

On the economic side, the Caixin Services PMI in China rose to 54.8 in September from 54.0 in August, marking the fifth consecutive increase in service sector production. Growth was boosted by a steady increase in total new businesses.

Investors are also preparing for Biden's victory in the US presidential election and expect he will deliver a bigger stimulus package after the election.

Global financial markets and investor sentiment will be affected by the new Covid-19 outbreak, as many countries witness a new intensification of the deadly virus spread, including large swaths of Europe and more than half of the American states. Accordingly, new social distancing rules are (re) imposed, which cannot have constructive economic consequences on the short term. Canada's Trudeau warned that his country was at a turning point in the second wave. In the United States of America, more than 7 million people have been confirmed infected with COVID-19 since the virus began spreading earlier this year, according to figures from Johns Hopkins University.

Across Europe, including the UK, there have been huge increases in coronavirus cases over the past few weeks after the reopening of large sectors of the economy, as well as schools and universities. Infection levels - and deaths - in the UK are rising at their fastest rates in months. Without prompt action, there are concerns that UK hospitals will be overwhelmed in the coming weeks at a time of year when they are already in their most crowded winter conditions with illnesses like influenza. The UK saw the most lethal outbreak in Europe, with the official death toll reaching 42,825, up by 65 more cases on Sunday.

Although Coronavirus cases have risen across England, northern cities such as Liverpool, Manchester and Newcastle have seen a disproportionate increase. While some rural areas in eastern England have fewer than 20 cases per 100,000 people, major metropolitan areas such as Liverpool, Manchester and Nottingham have recently recorded levels above 500 per 100,000, which is nearly as bad as in Madrid or Brussels.

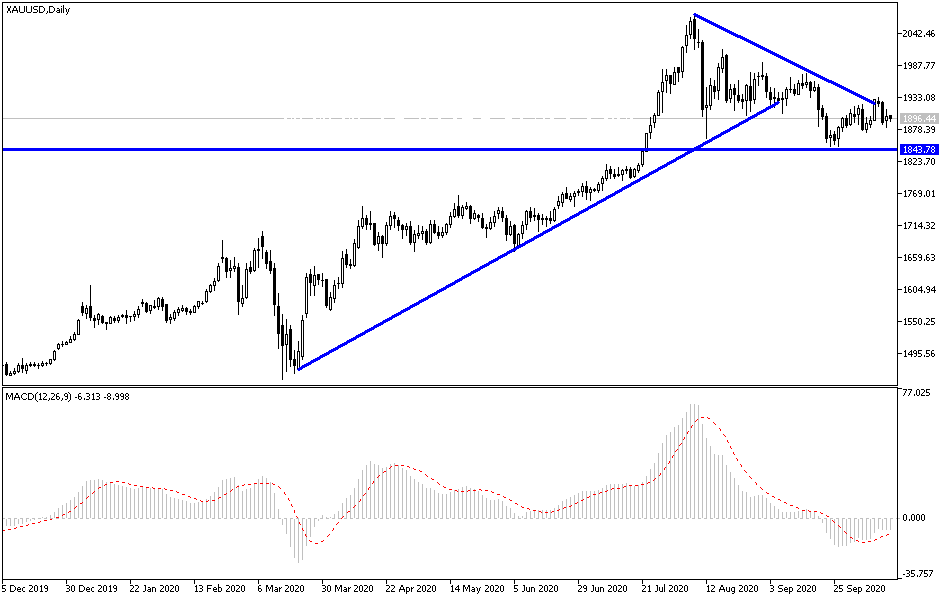

According to the technical analysis of gold: As I previously expected, gold prices stability around and above the $1900 resistance will stimulate more buying deals, and therefore gold will move upwards, especially if it coincides with the decline of the US dollar. The strength of the second coronavirus wave, political anxiety in the United States, and the flight of investors from risk will remain the most influential factors on the path of gold in the coming days. Currently, the levels of resistance at 1942, 1960, and 1975, respectively, will be the next bulls' goals, and if they occur, they will support the movement towards historical psychological resistance at $2000 again. On the downside, bears will regain control again if the gold price moves below the $1900 level again.

I still prefer to buy gold with every dip. Quiet moves are expected today in light of the US holiday and the fact that economic calendar is empty of important and influential releases.