The US dollar strength is still preventing gold prices from benefiting from the global anxiety of the second coronavirus wave, while the stimulus talks for the US economy have stopped. The disappointment of Brexit talks, as well as the US presidential elections’ future are all factors that motivate the gold price to move upward during the week’s trading. In the past, gold prices could only rise towards the resistance at $1933 an ounce. The strength of the US currency contributed to a downward correction towards the support at $1883 an ounce, before closing the week’s trading around the $1899 level. Today, the gold price will interact with the announcement of Chinese data, led by the growth rate of GDP and industrial production, followed by upcoming statements by both ECB Governor Lagarde and Federal Reserve Governor Jerome Powell.

According to the performance during last Friday's trading session, the price of gold continues to trade within the formation of a slightly bullish pattern. This comes after a significant drop in earlier trading in the week. The yellow metal price remains stable below the 100 hour and 200 hour SMA lines. Gold continues to trade near oversold 14-hour RSI levels despite a slight upward shift in market sentiment.

Gold prices are still turbulent as bears and bulls fight over control of precious metals’ direction. Recent trading sessions have pushed silver and gold prices down 3% and 1%, respectively. It marked the first weekly decline in silver and gold since September. Fundamentally, gold prices are still expected to fluctuate amid large swings in real yields and the US dollar.

On the economic side, the gold price is trading amid investor interaction with the announcement of the third-quarter earnings season numbers, as banks lead early releases. More earnings reports will be released over the next two weeks before the peak season in November. This could channel market momentum slightly in favor of stocks depending on how companies perform. But again, in November, the US elections could destabilize the markets a bit, which means that some investors may choose to stick to safe-haven investments like gold.

According to results from recent US economic data, we noticed a discrepancy in performance. The US retail sales numbers for September beat expectations by 0.2% with a reading of 1.4%. General retail sales for the period beat expectations (monthly) at 0.7%, with a reading of 1.9%, while retail sales without cars beat expectations by 0.5%, at 1.5%. The Michigan consumer confidence index for October also beat the expected reading of 80.5, with a reading of 81.2.

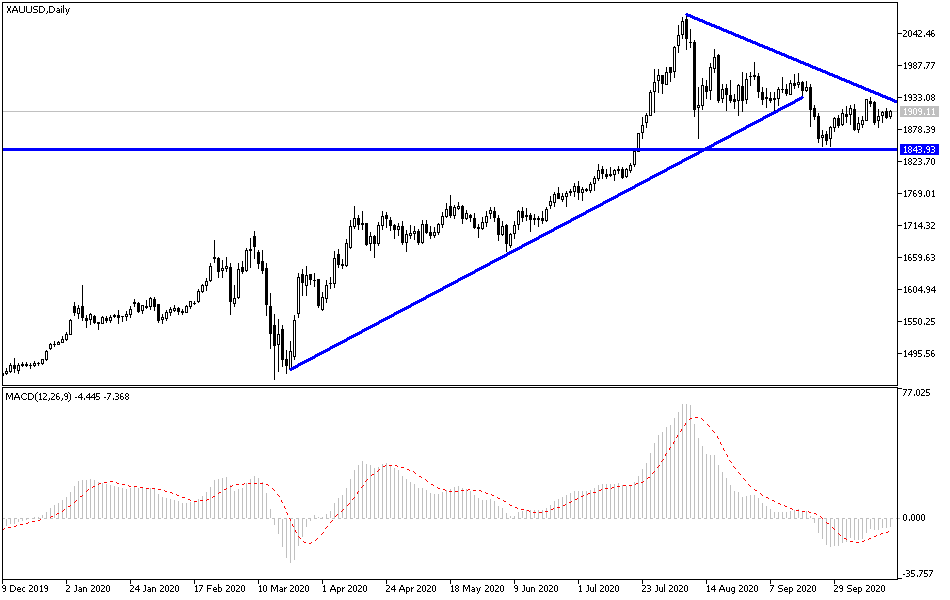

According to the technical analysis of gold: In the near term, and according to the performance on the hourly chart, it appears that the price of gold is trading within a slightly rising wedge formation. This indicates a slight bullish tendency in a relatively volatile market. Accordingly, bulls will target short-term profits at around $1.913 or higher at $1.933. On the other hand, bears will be looking for profits from a pounce around $1884 or less at $1,866.

In the long term, and according to the performance on the daily chart, it appears that the price of the yellow metal is trading within a sharp downward channel. This indicates a significant long-term bullish bias in market sentiment. Therefore, the bears will look to extend the current lows towards $1,815 or less at $1,738. On the other hand, bulls will target long-term recovery gains of around $1962 or higher at $2,046.