The halting of the US dollar's gains contributed to an upward correction in the gold prices towards the $1900 resistance before settling around $1896 per ounce at the time of writing. The catalysts for more gold gains are still in place and increasing, and therefore we expect positive price movements in the coming days. The precious metal experienced its worst monthly performance in two years, mostly driven by the strengthening of the US dollar. Despite a technical correction in gold prices, the consensus is that the commodity still has room for growth amid weak inflation and coronavirus uncertainty. Due to September's performance, the yellow metal posted a loss of 3.5%, narrowing its year-to-date gains to 25%.

Silver, the sister commodity of gold, is slipping in the middle of the week's trading as it prepares to post a two-digit loss. Silver futures fell 2.23%, at $23.90 an ounce. The white metal will end September down 13.5%. Metal commodities have been hit hard by the dollar's strength. The US dollar index, which measures the dollar’s performance against a basket of six major rival currencies, rose 0.01% to 93.90 from 93.89. During the month of September, the index registered an increase of 1.15%, which is the best monthly jump since July of last year. But the index is still down 2.6% since the beginning of 2020 until now. Generally speaking, stronger profit is bad for dollar-denominated commodities because it makes it more expensive to buy for foreign investors.

Gold and silver prices have declined over the past month, but analysts assert that the uncertainty in the future of the global economy, especially from the COVID-19 public health crisis, and fluctuations in global stock markets, will force more people to buy gold. When you factor in historically low-interest rates in the US and beyond, the long-term path for gold will remain positive.

Economic data hurt the metal markets on Wednesday. In September, the number of private-sector jobs in the United States increased by 749,000, while the GDP came in better than expected at -31.4% in the second quarter. Corporate profits also improved in the July-September period, down 10.7% from -11% in the previous quarter.

Relative to other metals markets, copper futures rose to $3.0385 a pound. Platinum futures rose to $911.40 an ounce. Palladium futures jumped to $2,341.39 an ounce.

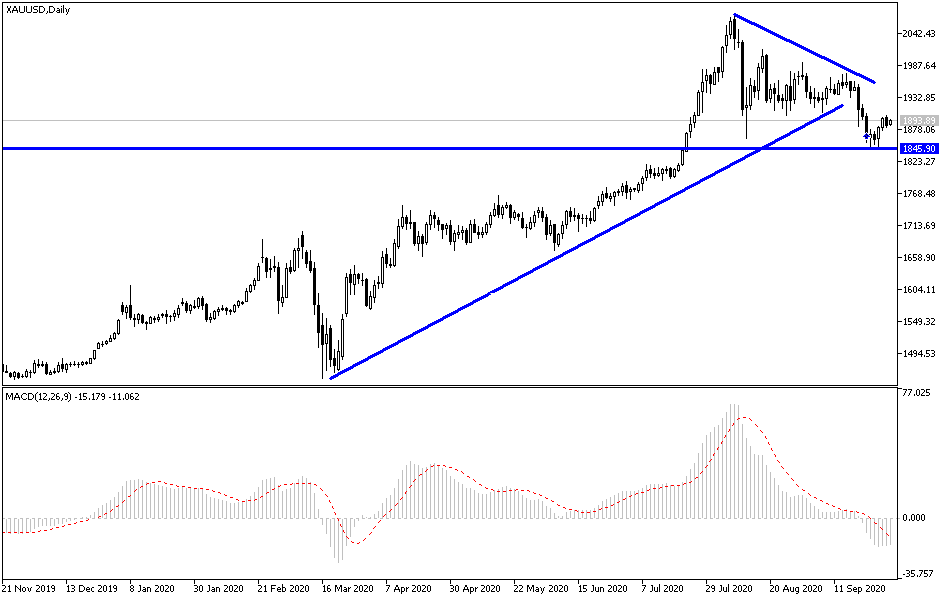

According to the technical analysis of gold: In the near term, it appears that the price of gold is trading within a downward channel on the hourly chart. This indicates a significant short-term bullish bias in market sentiment. The XAU/USD pair retreated late in trading on Wednesday to avoid crossing into the overbought levels of the 14-hour RSI. Therefore bulls will target short-term gains around $1,902 or higher at $1,921. On the other hand, the bears will be looking to gain from the pounce down around $1,868 or less at $1,851.

In the long term, and according to the performance on the daily chart, it appears that the price of the yellow metal has recently rebounded from the support line of the 100-day simple moving average. This came after the downward breach from a rising channel. Accordingly, the bulls will be looking to gain from the bounce by targeting long-term gains around $1931 or higher at $ 1980. On the other hand, bears will look to extend the decline to $1,842 or less at $1,800.

Today, gold will interact with whether or not investors are taking risks, as well as the announcement of the manufacturing PMI reading from Japan, the Eurozone, Britain, and the United States. Then the jobless claims numbers reading, the Federal Reserve’s favorite index to measure US inflation, personal consumption expenditures, and average spending and income for an American citizen.