For five consecutive trading sessions, the price of gold moved upwards with gains that reached $1917 an ounce during last Friday's trading. On the same day, it retreated to $1898 an ounce in light of the heavy buying of the US dollar by investors after the announcement of the US jobs report results. The yellow metal closed the week’s trading, stabilizing around $1900 an ounce, after the announcement of US President Trump's infection with the Coronavirus. The metal is preparing to achieve strong gains in the coming days, as the factors of its demand increased, the most prominent of which is the current future of the US presidential elections after Trump's illness, the strength of the second COVID-19 wave, and the efforts of countries and governments to contain the deadly disease. The return of the global economic shutdown supports the escape to buy gold. Besides that, we have the future of Brexit and the already tense US-China relations, as well as efforts by global governments and central banks to provide the necessary stimulus to prevent the global economy from collapsing.

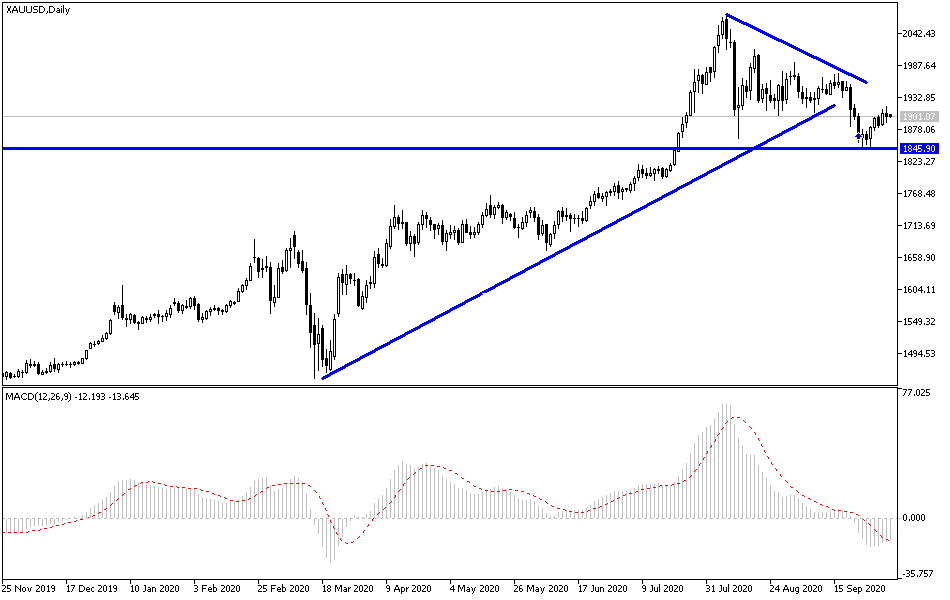

The price of gold regained some strength last week as it recovered from its worst level since July, and according to some analysts, it is very likely that this will not continue. According to them, there is a weak trend and resistance to the previous upside which seems determined to keep the precious metal headed down. By itself, retracement has a "wedge-like" corrective view. Therefore, the lower reversal and a move below the 1848 support will have a strong impetus for the next stronger downward move to $1800 an ounce, and this was the level at which gold appeared hesitant in July before rising to new record levels.

Gold futures rose about 2.2% over the past week. Silver futures ended lower at $24.029 an ounce, while copper futures settled at $2.9775 a pound.

On the economic front, data from the Labor Department showed that job growth in the United States slowed much more than expected in December, with employment in the non-farm sector increasing by 661,000 jobs, well below the expected increase of 850,000. In August, nonfarm payrolls increased by upgrading 1,489 million jobs. Despite weaker-than-expected job growth, the report said the US unemployment rate fell to 7.9% in September from 8.4% in August. The unemployment rate was expected to decline to 8.2%.

On the other hand, according to a report issued by the US Commerce Department, US factory orders increased by 0.7% in August after rising by an upwardly revised 6.5% in July. Economists had expected orders to jump by 1% compared to the 6.4% increase originally recorded from the previous month. The report mentioned that durable goods orders increased by 0.5%, while non-durable goods orders increased 0.8%.

Finally, revised data released by the University of Michigan showed that consumer confidence in the US improved by more than previous estimates in September, with the index revised up to 80.4 from the initial reading of 78.9. Economists had expected the index to be revised up to 79.0.

According to technical analysis of gold: There is no doubt that the $1900 resistance is important for the bulls to control the performance of the gold price in the medium and long terms because it will support more purchases to push the yellow metal towards stronger record levels the closest of which are currently at 1915, 1927 and 1955, respectively. On the downside, a breakout below the 1883 support will increase the sell-off towards the 1860``support, and in general, gold investors are still waiting for the decline to return to buying gold again. Gold will interact with the global geopolitical tensions and the services sector PMI reading for the Eurozone, Britain, and the United States of America.