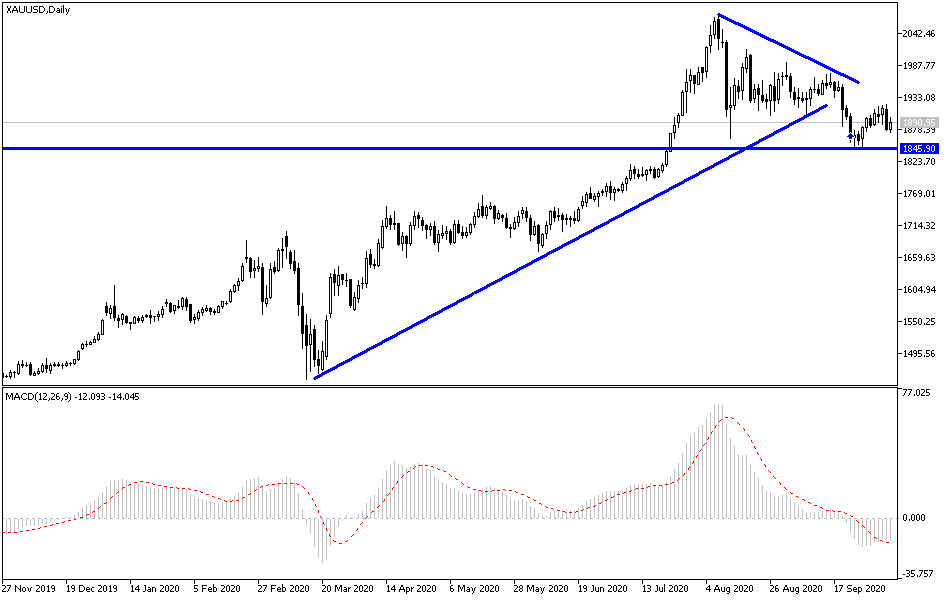

The US dollar recovered amid noticeable activity in the forex market after statements by the US President and Federal Reserve Governor Jerome Powell contributed to the decline in the gold prices towards the $1873 support. We have mentioned in recent technical analyses that the decline in gold prices is a buying opportunity, which allowed the yellow metal to move towards $1898 an ounce at the time of writing. The drop in the US dollar index, DXY, was an additional catalyst for buying. Therefore, the drop of the US dollar, along with the doubts surrounding the US presidential elections, may continue to act as a positive catalyst for the yellow metal in the short term. However, the average trend for gold prices continues to shift to the downside, as prices have established consecutive lower lows and lower highs since August.

Gold prices retreated from their two-week highs as traders took cautious moves while closely monitoring developments regarding the potential US coronavirus relief package. House Speaker Nancy Pelosi and Treasury Secretary Stephen Mnuchin spoke by phone for about an hour about coronavirus relief on Monday, but they walked out without an agreement.

They are expected to speak again, to continue the recent wave of activity working towards an agreement on legislation.

Risk sentiment improved after US President Donald Trump's hospital discharge eased political uncertainty. However, the downside to gold was limited as concerns about growth remained persistent due to the continuous rise in the number of new coronavirus cases worldwide. On the other hand, Federal Reserve Chairman Jerome Powell said during his speech at the National Association of Business Economics that the US economic recovery has remained far from complete and that the economy needs more financial support. "The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work hand in hand to provide support for the economy so that it clearly emerges from the impasse," he said.

As for the future of global trade, a report by the World Trade Organization said yesterday, Tuesday, that the volume of global trade is likely to decline less than expected this year. The expected recovery next year will not return it to pre-crisis levels, as it warned of the downside risks from the resurgence of Coronavirus infections in the coming months. Global merchandise trade volume is expected to decline by 9.2% this year, well below the 12.9% decline expected in an optimistic April scenario.

According to the technical analysis of gold: Gold prices rebounded from $1,884 (the 100-day simple moving average), looking to push the key resistance at the Fibonacci (61.8% retracement) trading around the $1910 resistance level. A strong breakout above $1.910 could open the door for a more Bullish direction to next resistance at $1.942, Fibonacci (50% retracement level). Some harmonic fluctuations have been observed, indicating a clear downtrend over the past two months. Failure to break above $1.910 could lead to a new harmonic bounce back to the key support levels trading at $1,872.

In the short term, the outlook for gold depends heavily on the direction of the US dollar index, DXY, due to its negative correlation during the past few days. On the other hand, silver prices also lagged behind gold, facing a difficult resistance level at $24.50. However, it appears that gold prices have entered the consolidation phase of the massive bullish trend, with key support levels trading at $1,800. The macroeconomic environment remains very favorable to gold prices, despite a recovery in the near term.

IGCS shows that gold traders are largely on the buy side, with about 74% of positions being net buy while 26% are net short positions.