The recovery of the US dollar was a good reason for the retreat of gold prices to the $1882 support at the beginning of Wednesday’s trading, before the price of the yellow metal stabilized around $1897 an ounce at the time of writing. The greenback's strength is back after optimism about fiscal stimulus faded slightly. Nevertheless, it appears that the ongoing surge in coronavirus cases has limited gold's losses. On the Covid-19 front, Johnson & Johnson said it had temporarily halted a trial of a Covid-19 vaccine due to unexplained disease in one of the participants, raising uncertainty about the timing and effectiveness of the vaccine. According to reports, coronavirus cases have soared in many parts of the world, and several countries have re-imposed social distancing measures and announced new closures to limit the spread of the virus.

Silver futures closed 4.5% lower at $24.129 an ounce, while December copper futures settled at $3.0445 a pound.

US reports on the CPI for September. The headline rate is expected to rise to 1.4% from 1.3% in August. It will be at the highest level since March. Remember that it was at 2.3% at the end of last year, due to the underlying effect, the same 0.2% monthly rise would keep the base rate unchanged at 1.7%, which was also the highest since March. The base rate was 2.3% at the end of 2019 and 2.2% at the end of 2018.

On another level, Chinese trade figures showed that the September surplus decreased to $37 billion from about $59 billion. The median forecast in a Bloomberg survey was a $60 billion surplus. The main reason behind this decline was imported, which increased by 13.2% (-2.1% in August). Economists had expected an increase of less than 0.5%. Imports may have been affected by the build-up of stocks before the US sanctions. According to official figures, exports to the United States increased by 20.5% (9.5% in August), while imports from the United States increased by a quarter. The bilateral surplus was $30.8 billion. On a larger scale, exports increased by 9.9% year-on-year, which was not expected from the median forecast. It should be noted that exports of medical devices rose by about 31%, and the category that includes face masks increased by about 35%, both of which were lower than in August.

The German ZEW investor survey for October was a bit disappointing, whereas the expectation component decreased more than expected to 56.1 from 77.4. It was the first drop since July and the lowest since May. The current situation assessment improved to -59.5 from -66.2 in September. It is the least negative since March. The survey is important because it gives an impression of the feeling of the largest economy in Europe and the Eurozone in particular.

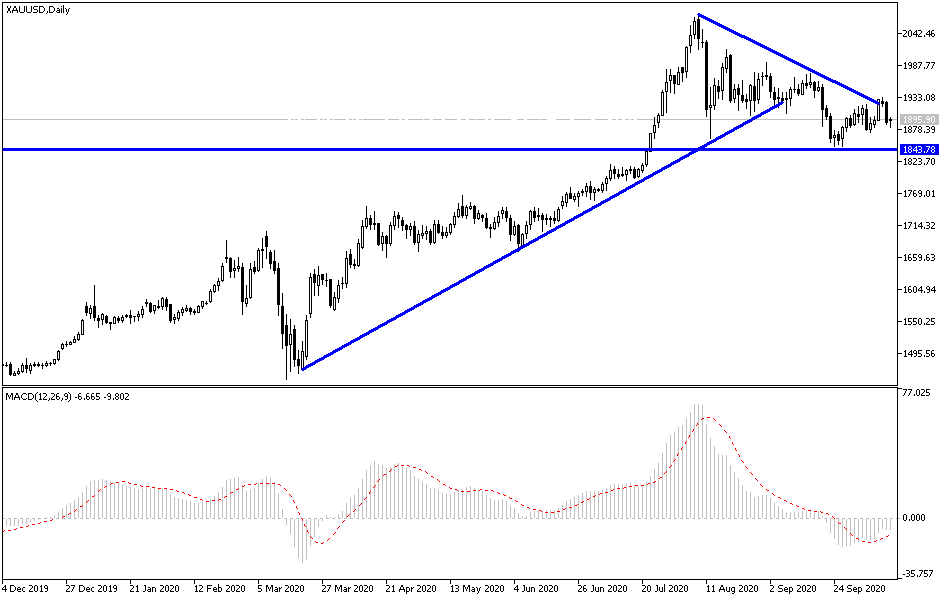

According to the technical analysis of gold: There is no doubt gold prices breaking below the $1900 resistance negatively affect the bullish expectations, but at the same time, it means waiting for new buying levels, the closest of which are currently 1883, 1874, and 1860, respectively. I still prefer to buy gold from every downward level, as global concerns about the strength of the second Coronavirus wave, in addition to the growing political anxiety in the United States of America and a bleak future for Brexit, and other factors will continue to support the continued strength of gold in the long run. On the upside, as I mentioned before, stability above the $1900 resistance will stimulate more purchases of the yellow metal. Hence, pushing it towards stronger ascending levels.