Gold prices attempt to rebound during yesterday's trading session culminated in testing the resistance at $1932 an ounce. After several trading sessions in which the price of gold remained stable in a limited range, awaiting stronger incentives. The price of gold is stable at around $1916 an ounce at the time of writing. Gains were strongly supported by the weakening US dollar. Reports showing the continued rise in Coronavirus cases around the world also contributed to the rise in the price of gold. The dollar fell due to continued optimism about US fiscal stimulus. Despite the current deadlock over the stimulus talks, it is widely expected that lawmakers will eventually reach a compromise by the end of this week. The trend of the gold market may maintain the current state of affairs as Fed officials maintain cautious monetary policy guidance.

Another monetary stimulus package may keep the FOMC in check, as Richard Clarida, Vice President of the Federal Reserve, confirmed that the committee has already made some critical changes to its policy statement that has raised its future guidance regarding future outlooks for US interest rates. .

The Dollar DXY Index dipped to a low of 92.47, and although it rose slightly after that to 92.56, it was still significantly lower, posting a loss of more than 0.5% from the previous close. Accordingly, silver futures rose to settle at $25,241 an ounce, while copper futures for December settled at $3.1985 a pound.

On the US stimulus front, House Speaker Nancy Pelosi and Treasury Secretary Steve Mnuchin are expected to speak again as they seek to reach an agreement on a new relief package before next month's elections. In a post on Twitter, Pelosi's deputy chief of staff Drew Hamill said the House Speaker and Secretary of State have called on committee chairs to work on resolving differences over funding levels and language.

On another level, a Fed survey of business conditions across the country found that the US economy grew at a "slight to modest" pace in September and early October, but it also documented several areas of economic activity that have been hobbled by the coronavirus pandemic. The beige book found that while consumer spending, which accounts for two-thirds of US economic activity, remained positive, some regions reported stabilizing retail sales, which could be linked to the end of subsidy programs in the summer.

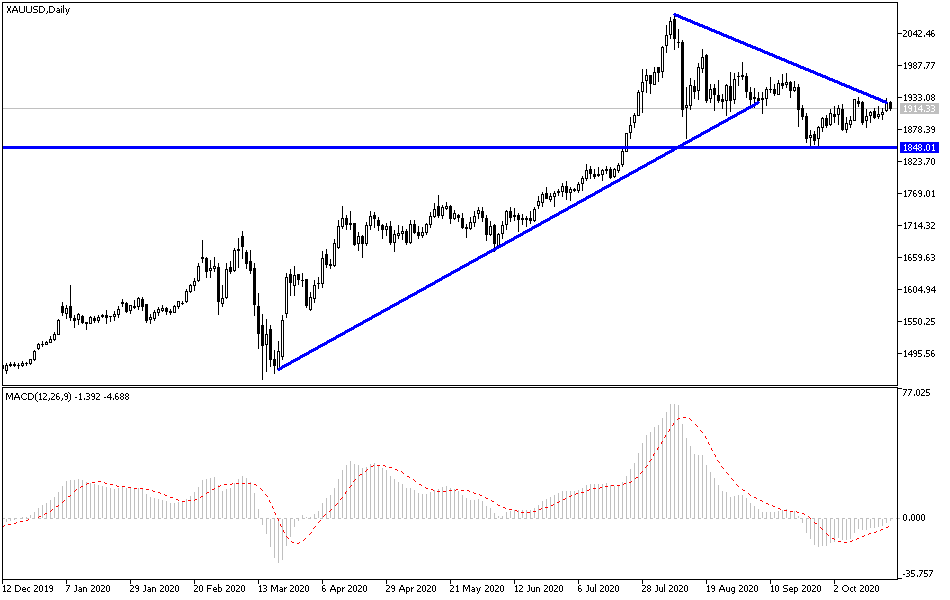

According to the technical analysis of gold: As I expected before, the stability gold price above the $1900 resistance will continue to stimulate the bulls to push towards stronger bullish levels and test some of the levels of resistance that I set in the past, and with the stability of the price of gold near those levels, I still see that the ascending path is ready to test the resistance levels at 1927 1941 and 1960, respectively. This depends on the continued weakness of the US dollar and the extent of investor risk appetite. Continued uncertainty about the future of the global economy with the Coronavirus will continue to be a catalyst for the yellow metal to continuously achieve gains. On the downside, and according to performance on the daily chart, the $1885 support will remain the most important for the bears to dominate again.

Regarding today's economic calendar data: All focus will be on new statements from the Governor of the Bank of England. US data will include unemployment claims and existing home sales, followed by the Eurozone consumer confidence reading.