For three trading sessions in a row, gold prices are moving in a limited range between $1892 and $1910 an ounce, where it is stable around at the time of writing. Despite increasing factors that support more gains for the yellow metal price, the USD strength prevents the price of gold from rebounding to achieve stronger gains. Concern about the future of Brexit and who will win the US presidential elections and stimulus plans for the US economy, along with the strength of the second wave of the Coronavirus outbreak are all very important factors supporting the long-term gains in the gold prices. Gold investors are waiting for any dip below $1900 an ounce to consider buying gold.

The yellow metal's appeal as a safe haven has increased after a sell-off in global stock markets amid an increase in coronavirus cases around the world. Diminishing optimism about the US stimulus package ahead of the presidential election, weak new home sales data and the USD strength, all limited the rise in the price of gold. December silver futures closed down $0.255, or about 1%, at $24,420 an ounce, while December copper futures were down $0.0395, or 1.3%, and settled at $3.0895 a pound.

On the economic news front, new home sales in the US unexpectedly showed a sharp decline in September, according to a report by the Commerce Department. According to official figures, new home sales fell 3.5% in September to a seasonally adjusted annual rate of 959,000 million units, as the hot summer home buying season slows down. For its part, the Commerce Department said that despite the modest decline, new home sales increased by 32.1% from the previous year. However, the pandemic may begin to affect the market as the cold winter months arrive and as coronavirus cases rise in most parts of the United States.

“While strong demand and low mortgage rates support home sales, the resurgence of Covid-19 cases, a recovery that may turn in the opposite direction and a weak job market pose downside risks,” said Nancy Vanden Houten of the University of Oxford Economics.

The US housing market, like most of the economy, almost stalled in March and April, causing the spring and summer buying season to be delayed until summer. Once economies reopened, pent-up demand translated into sales of both new and existing homes, pushing home prices in many places to record levels. In July, home sales increased by 13.9%. The July numbers could be on top of the housing market. August new home sales were revised down to 994,000 from the previously reported 1.01 million units.

According to the US Commerce Department, the average selling price of a new home was $326,800.

As for stopping the economic stimulus, Fed officials have expressed concerns about that. Accordingly, Lyle Brainard, a member of the Federal Reserve Board, warned last week that the most serious risk to the economy is the lack of further stimulus and the continued outbreak of the virus. Brainard told the Association of Professional Economists that ending federal aid prematurely would affect employment and spending and cause more trade failures.

The $2 trillion CARES Act enacted by Congress in March eased the recession pain by increasing income and spending and supporting small businesses. For his part, Fed Chairman Jerome Powell said that the stimulus prevented a "downward spiral" recession, as it would reduce spending, which could lead to more job cuts and spending cuts. Powell cautioned that these dynamics could re-emerge without additional help.

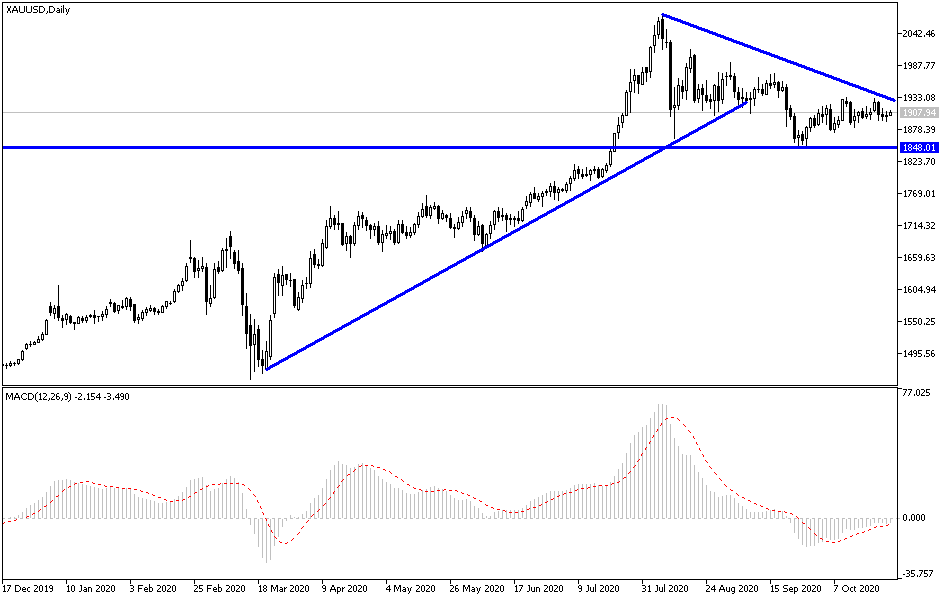

According to the technical analysis of gold: There is no change to my technical view of the gold performance. Stability above the $1900 an ounce resistance gives the bulls the opportunity to move higher and test stronger levels, the closest of which are currently at 1917, 1935 and 1960, respectively, and the last level may support the next stronger move towards the historic peak at $2000 again. On the downside, the support level at $1,885 is still important for bears' fresh control of performance. As I mentioned at the beginning of the analysis, gold investors are waiting for a retreat below $1900 to consider buying again. The price of gold will interact with the extent of investors’ risk appetite, as well as the release of US durable goods orders numbers and consumer confidence.