Gold markets have rallied a bit during the trading session on Wednesday as the $1900 level has been important yet again. At this point, the 50 day EMA is slicing through the last several candlesticks, and at this point, it is likely that the market simply is calming down as we wait to see what happens next with stimulus. With a lot of concern around the world when it comes to the global economic situation, then it makes quite a bit of sense that gold does not necessarily know where to go at the moment because quite frankly the US dollar does it nowhere to go.

Obviously, one of the biggest stories out there right now is whether or not we are going to have a stimulus in the United States. This would weigh upon the US dollar in general, as it would flood the market with more liquidity, and would extend US dollar selling. However, we have seen a lot of questions as to whether or not stimulus can be passed anytime soon, and I think that the market is starting to price in the idea that at the very least, we will not be finding stimulus between now and the election in the United States. Furthermore, there are some other questions as to whether or not stimulus will be enough and how big it will be.

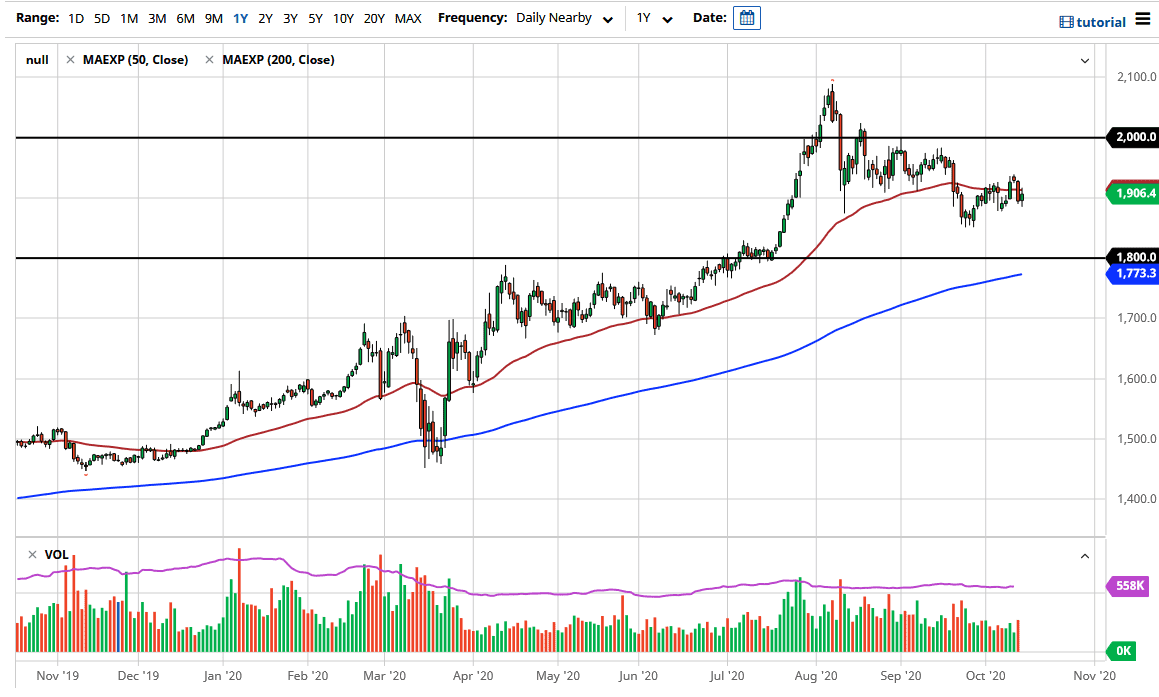

Looking at the chart, you can see that the $1900 level continues to be an area of interest, but I think that there are major buying areas underneath, all of which I am more than willing to pay attention to. I believe that the $1850 level is significant support, but below there I would anticipate seeing even more support closer to the $1800 level, which also has the 200 day EMA racing towards it, so I believe that a longer-term “buy-and-hold” type of situation probably form to that area that I will be buying and keeping in my portfolio for a huge move. I have no interest in trying to short this market because gold is most certainly in a major uptrend. With that, it is simply a matter of patience. However, if we were to break above the $1940 level, then we have another $20 or so to go, and then eventually reach towards the $2000 level. I am either flat of this market or buying, with no interest whatsoever in selling.