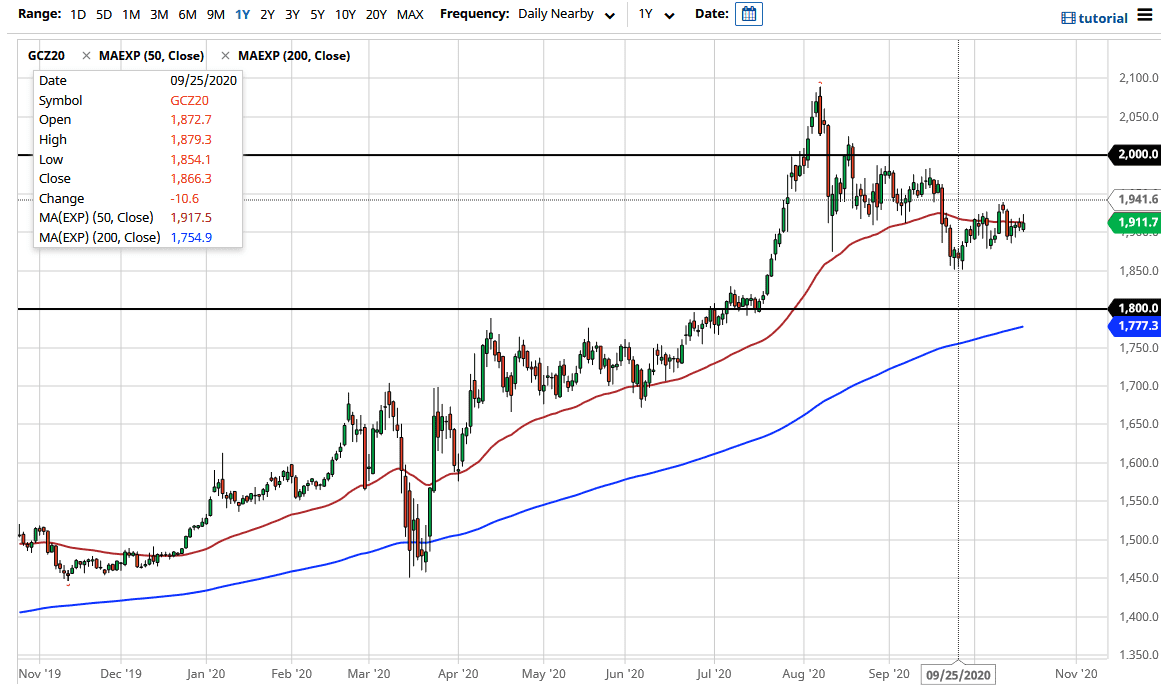

The gold markets initially rallied during the trading session on Monday to kick off the week, as the US dollar got sold off in Asian trading. Having said that, we broke above the 50 day EMA as a result, only to turn around and form a bit of a shooting star. The shooting star sitting on top of the $1900 level is more than likely going to mean something, if for no other reason than the fact that it is sitting at a large, round, psychologically significant figure.

Breaking down below the $1900 level suggests that the market is going to go down to the $1850 level, where we bounce from previously. We had seen four attempts to break down through it a couple of weeks ago, and you will notice that all four of those daily candlesticks did hold as support. If we were to break down below the $1850 level, then it is likely that the $1800 level underneath will be targeted. That was a major breakout that I think is only a matter of time before we would see plenty of interest. Furthermore, the 200 day EMA is racing towards that area so I think it gives yet another technical reason for traders to be involved, perhaps trying to pick up bits and pieces of value. With that being the case, I think that it will be the “floor in the market” going forward. After all, even if the US dollar strengthens quite drastically due to a safety play, eventually gold will strengthen right along with it.

In the meantime, it does look like the US dollar has been strengthening and probably will continue to going forward. Ultimately, this is a reaction that we typically have, but eventually, things will start to follow the larger macroeconomics, which suggests that with weakening central banks when it comes to monetary policy, that should have people looking towards the purchase of hard assets such as gold. Beyond that, we have a lot of concerns when it comes to global growth, and the coronavirus causing issues and slowdowns in markets around the world as well. In general, gold will be used as a safety asset, and perhaps a way to get away from softening fiat currencies as central banks around the world will fire up the printing presses in the current environment.