Gold markets have rallied again during the trading session on Wednesday as we continue to see bickering and hints about what may or may not happen with stimulus in the United States. Currently, the United States Congress is debating with White House members as to whether or not there will be stimulus, and how much. The question is whether or not it can be done before the election, but it is at this point that I would point out Wall Street seems to be looking past that. A lot of the gains that we see, and gold happen early in the US session, so it is obviously driven by New York trading.

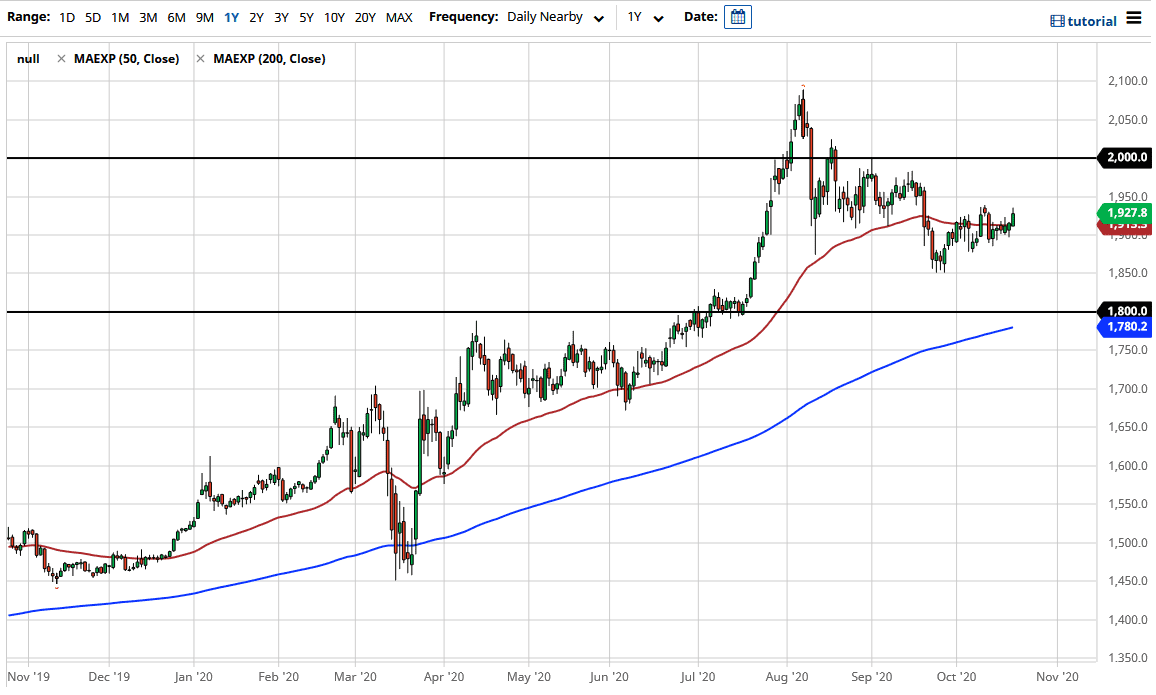

To the downside, I believe that the 50 day EMA continues to offer support, just as the $1900 level does. I also believe that there is a highly probable cause for some type of pullback, but that pullback will probably be picked up as potential value. I have no interest in shorting the gold market, because quite frankly central banks around the world should continue to flood the markets with plenty of currency, and that by its very definition typically will drive up the value of the precious metals markets, with special attention paid to gold.

Even if we do break down below here, I like the $1850 level, and the $1800 level as the 200 day EMA is racing towards that round figure. The $1800 level was a sign of the next leg higher as it was a major breakout, and it should have a certain amount of “market memory” built into it. This does not mean that we get down there, but I would be much more aggressive about buying on that dip towards that area. Regardless, I will not be shorting this market. There are far too many reasons to think that eventually, we have plenty of buyers. If we do get massive stimulus, that could push gold towards the $1975 level, possibly even the $2000 level. If we retake the $2000 level, gold is going to go much higher as it would be a continuation of the overall trend. It is not until we break down below the 200 day EMA that I even entertain the idea of shorting gold. Pay attention to the US Dollar Index, as the negative correlation is still rather high.