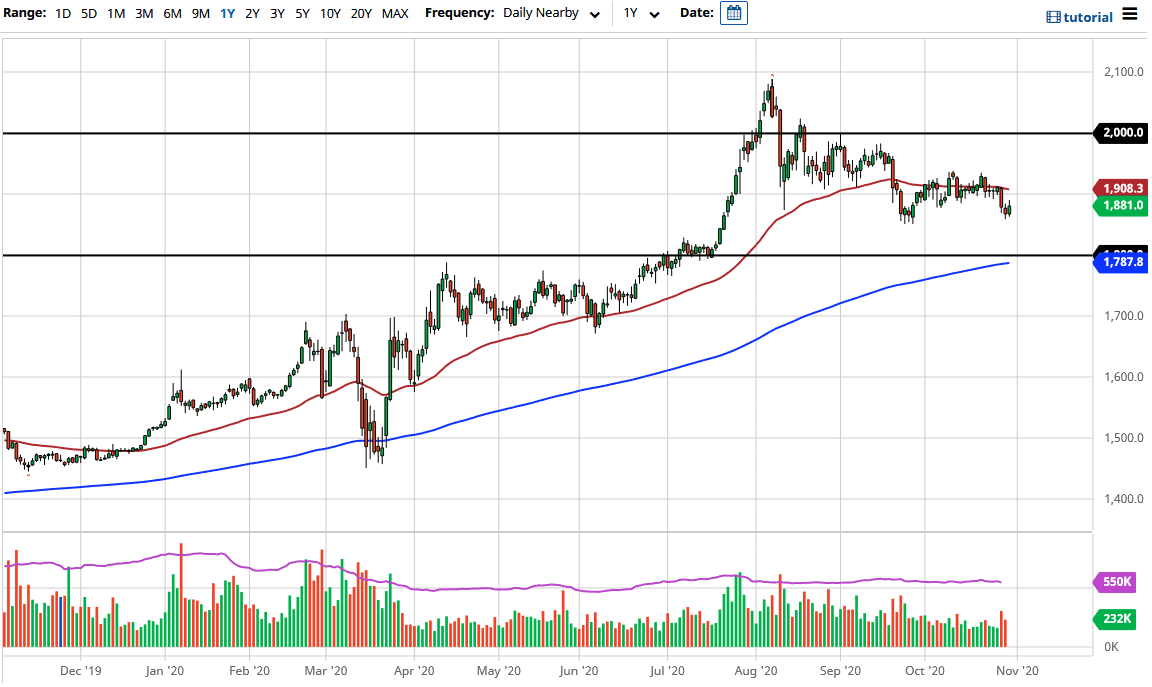

Looking at this chart, the 50 day EMA sits just above and it does make quite a bit of sense that we would see some resistance. That being said, we have closed right at the 50 day EMA so it does suggest that perhaps we have a little bit of a fight here. Having said all of that, I still believe in the uptrend, so therefore I am not looking to sell the market.

Pay attention to the US Dollar Index because it certainly has a major influence on what happens in the gold market, although it does not necessarily show the only reason that we can get involved in the market. Looking at the candlestick for the day, we are closing towards the top of it, so it is also important. Breaking above the top of the candlestick and more importantly the 50 day EMA, opens up the possibility of a move towards the $1956 level where we had seen a lot of selling pressure.

To the downside, I believe that the $1850 level is going to offer a significant amount of support based upon the recent action, but I would not be surprised at all to see this market break down below there to go looking towards the $1800 level, an area that has been massive support previously as well as massive resistance. The 200 day EMA is sitting just below there and I think it is only a matter of time before buyers would come back in. If we were to break down below the 200 day EMA, then I think you have to worry about the overall trend. Pay attention to what central banks are going, but it looks to me like people are very concerned about the money printing, and that of course should send this market much higher. The $2000 level is above and offering resistance, so if we were to break above there then it should kick off the next leg higher, perhaps continue much higher over the longer term. I do believe in buying dips, but I would build a position slowly.