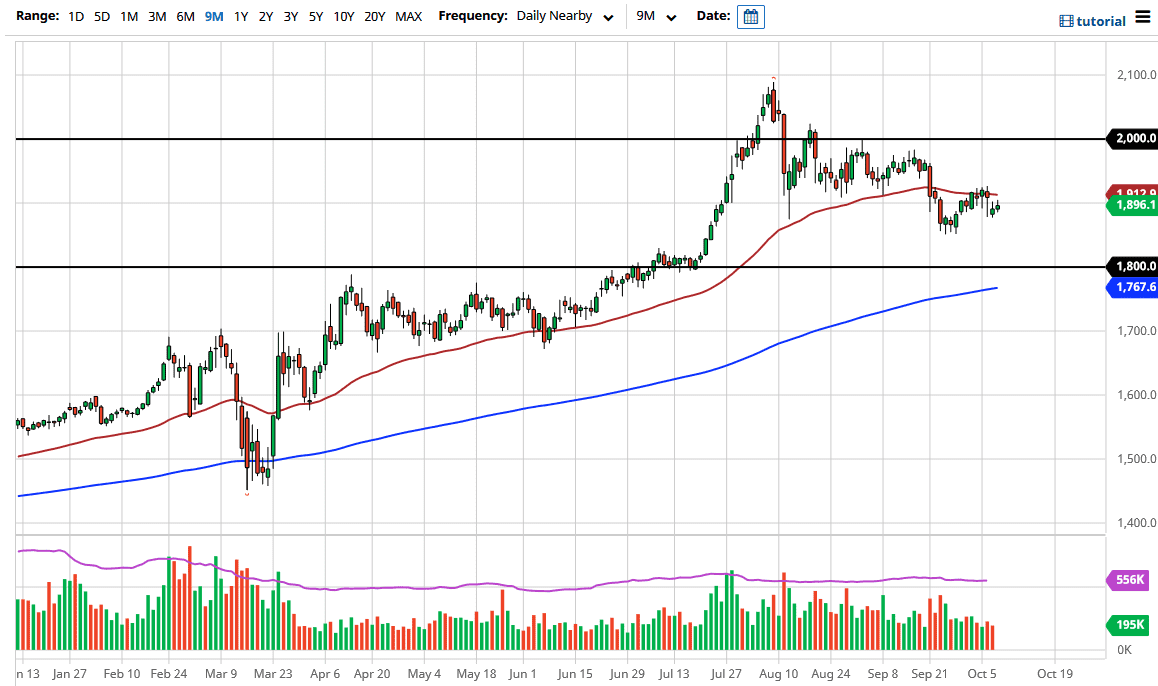

Gold markets rallied just a bit during the trading session here on Thursday but continue to struggle with the idea of getting above the gap. Because of this, I believe it is only a matter of time before the sellers come in on any short-term rally, unless of course suddenly the US dollar gets crushed. That being said, it appears that the market is paying close attention to the 50 day EMA, which of course is very important to pay attention to from a technical analysis standpoint. It appears that the market has been very observant of the 50 day EMA for quite some time, so it does make sense that we would see potential sellers.

To the downside, the market sees a lot of interest near the $1850 level, which is where we bounce from previously. I do believe that it is probably only a matter of time before reach down towards that area, but I would also point out that the level is more of a minor area than anything else. After all, the real surge higher started at the $1800 level, which I do think that we could very well see eventually. When you look at the last couple of months, we have simply drifted lower, and more of a downward grind than anything else. I anticipate we are probably going to see more of the same.

Looking at the candlestick for the day, it is a little bit of a shooting star, but the most important part to pay attention to is probably the fact that the market is struggling to get above that gap. I think you are probably better off fading short-term rallies unless of course we see some type of major shift in attitude. If we can break above the highs from both Monday and Tuesday, then you can make the argument that we are going to go looking towards the $1950 level above where I see a lot of supply. Either way, keep a close eye on the US Dollar Index, because the dollar negative correlation is still rather strong between the greenback and gold. With that in mind, it is worth noting that recently the US dollar has tried to recover and flex its muscles against various currencies around the world. It has not quite broken out yet, but it clearly is stronger than it was.