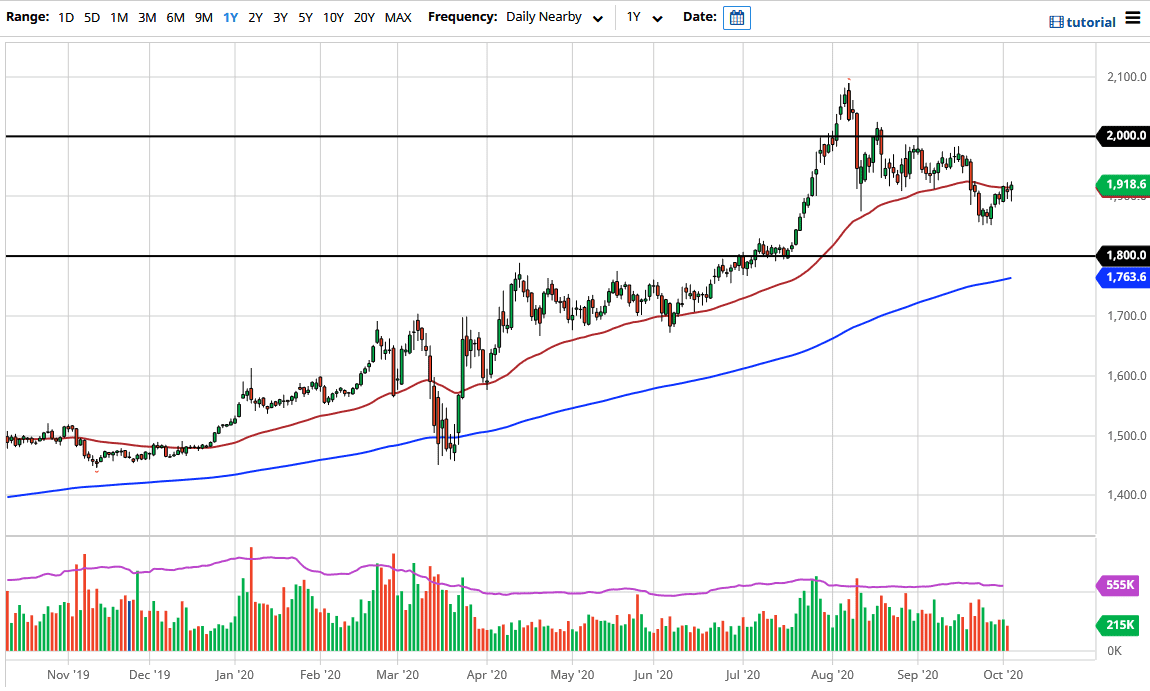

Gold markets initially fell during the trading session on Monday, as we reached below the $1900 level before buying again. Ultimately, the market has ended up forming a bit of a hammer for the trading session and that is a bullish sign. However, it is not until we break above the daily candlestick highs that I would be jumping into the market. At that point, I would fully anticipate that the market will go looking towards the $1950 level, perhaps even higher than that. However, you should also pay close attention to the US Dollar, as the negative correlation between gold and the US dollar has been rather strong over the last 90 days or so.

Looking at this chart, if we were to break down below the bottom of the candlestick then the gold markets continue to go lower. At that point, I would anticipate that the $1850 level should offer a bit of support and is thought of as a minor support level. A breakdown below there would be much easier than last time and could open up the possibility of reaching down towards the crucial $1800 level underneath which was the scene of a major breakout. That former resistance level will almost certainly cause a certain amount of support based upon “market memory”, and as per usual, it will attract quite a bit of trade flow.

Looking at this chart, the market is likely to continue to see a lot of shaky behavior, and therefore will move on to the latest rumors or headlines involving Donald Trump, the possibility of stimulus, Brexit, and God knows what else. I believe at this point in time, is likely that the market will be noisy and therefore it will more than likely be difficult. I would use smaller positions at this point in time, as the noise will be almost unbearable at times, and therefore a small position will keep you out of serious trouble which could pop up at any time with the way the markets are behaving. We are moving on the latest headlines more frequently than not, so therefore although I favor the upside and have no interest in shorting, I recognize that you cannot jump “all in” and take a ton of risk right now.