This is a market that I believe is probably waiting on some type of solution to the idea of stimulus, which seems to be less and less likely every day. Ultimately, the presidential election is in the way, so stimulus is all but a pipedream at this point. If there is no stimulus, that could stabilize the US dollar, which of course will work against the idea of gold shooting straight up in the air. This does not mean that both cannot go higher, just that it has for a completely different set of reasons that people were buying gold previously.

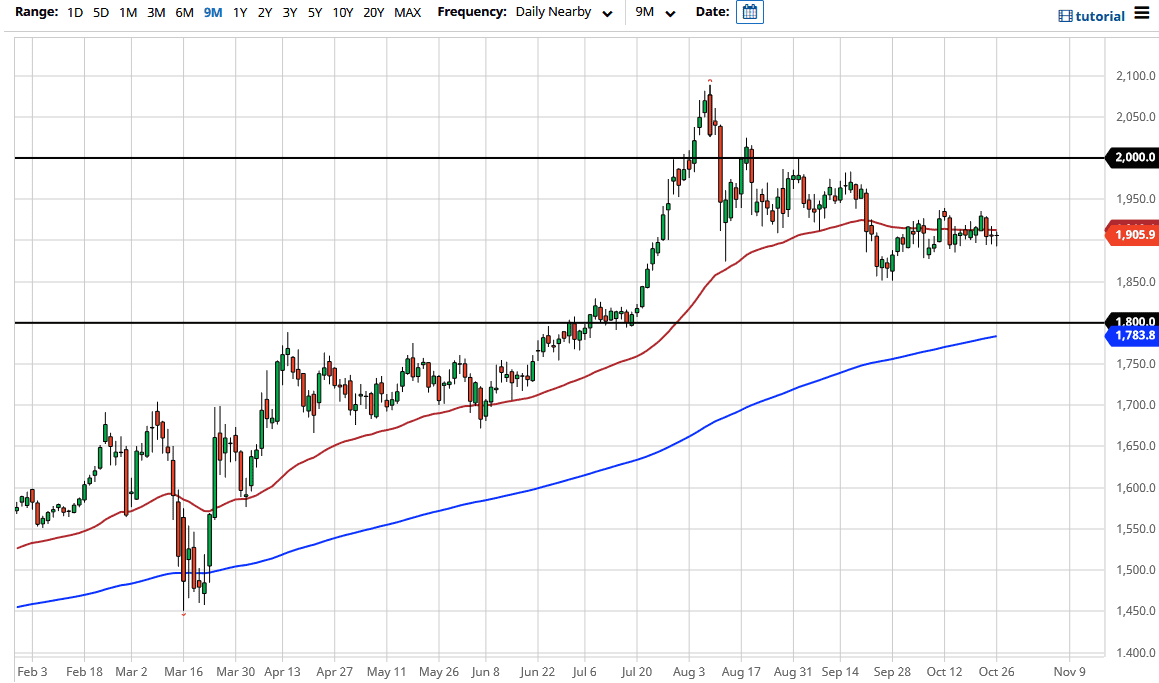

At this point, the $1900 level is significant and could be a supportive level, but even if we break down below there, the market has plenty of support near the $1850 level. That was where we bounce from previously, and as we break down below there, then it is likely that the market could go down to the $1800 level, which where we had recently broken out of, which has not been retested. Typically, these major breakouts do get retested eventually, so it is worth paying attention to. The 200 day EMA sits just below there, so that is also worth paying attention to as well. At this point, I believe that any bounce will be looked at as a potential turnaround, but I am going to take advantage of daily candlesticks, not short term. This is because gold has a lot to work through, not just the idea of the precious metal trade, but also the idea of whether or not there is going to be stimulus, whether or not Brexit is going to hold it together, or even the presidential election. In other words, we have a ton of moving target set the same time, and that is something to pay attention to. With all of that noise, it is likely that we just do not have enough clarity to be putting a lot of money to work.

Longer-term, I do believe that was central banks out there working as hard as they can to flood the markets with liquidity, gold is likely to continue going much higher. That makes it more of an investment and less of a trade, which of course is perfectly fine but if you are going to do that type of investment from a “buy-and-hold” type of standpoint, you need to do it off of a daily close, perhaps even a weekly close.