The bulls tried to push the GBP/USD pair towards the 1.3000 psychological resistance during last week's trading. Attempts around the 1.2978 resistance stopped and retreated during Friday's session to the 1.2836 support after the announcement of US President Trump's infection with the Coronavirus, at the time when US jobs numbers announcement was made, which produced mixed results. The pair succeeded in closing the week’s trading around the 1.2936. What contributed to the pair's recent gains was the weakness of pessimism regarding the Brexit process outcome, which may continue to support the British pound and may give it more strength in the coming days.

Political leaders on both sides of the Brexit table urged negotiators to intensify trade talks during the coming weeks, seeking to reach an agreement that could be signed at the European Council meeting in mid-October. For the time being, this excludes the possibility of an abrupt end to the talks. Markets were concerned that a no-deal Brexit was becoming more likely, but the mood in London brightened last week, as Downing Street and British negotiators saw an improvement in the odds of a deal.

Jane Foley, senior foreign exchange analyst at Rabobank, says: “The British pound has been hit by headlines in recent days with regard to the outlook for the Brexit trade deal between the UK and the European Union, and sterling investors are still focusing on this.” British negotiator, David Frost, acknowledged on Friday that serious obstacles to a trade agreement remained, but said he and others could see the outlines of a deal that could be made, which enabled the British pound to recover more of its losses in September against a range of currencies including the US dollar.

In general, the pound sterling will be subject to any news headlines about the future of Brexit, which makes the new calm seems to be misplaced. What added to the pressure on the pound was the return of losses to global stock markets after President Donald Trump announced that he was infected with the Coronavirus. He was rushed to the hospital on Friday, and there have been conflicting reports since then about his condition, although his doctor described him as having mild symptoms while he was in good spirits. All in all, his illness has put question marks on the schedule for the November 3 elections, which means that markets now face a 14-day wait before the exact impact of the disease on the 74-year-old US president becomes clear.

In general, in addition to the future of Brexit and Trump’s condition, the attention of the British pound will be on the Governor of the Bank of England, Billy, who is scheduled to participate in a panel discussion at the European Central Bank event next Thursday at 08:25, and the August GDP data due on Friday. Investors will be looking to hear any comments on the outlook for the monetary policy including the possible future use of negative interest rates while there is consensus that the British economy expanded by 4.6% in August after growing 6.6% in July.

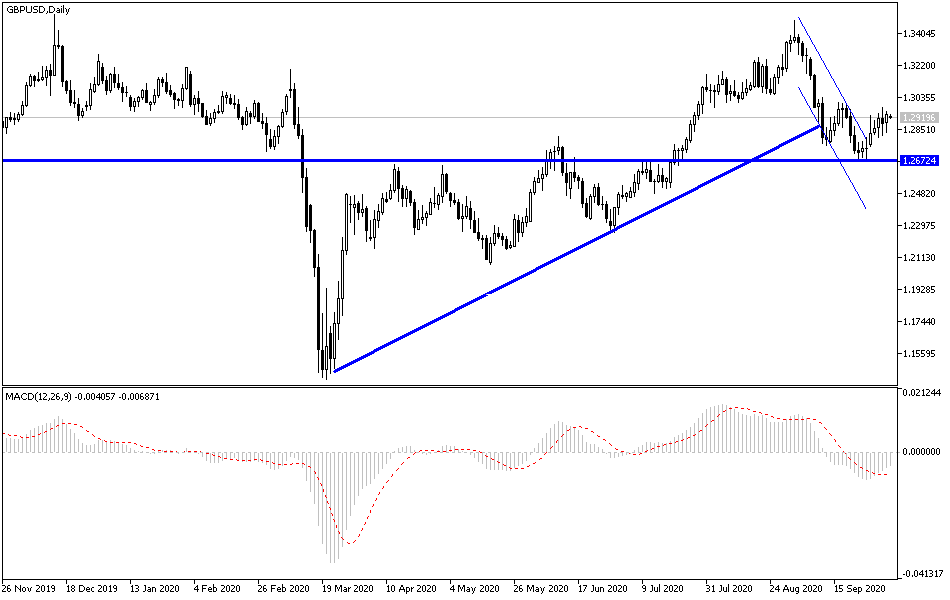

According to the technical analysis of the pair: No change in my technical view, and as I mentioned in the past, the 1.3000 psychological resistance will remain important for the bulls to control the GBP/USD performance, and it may cross this barrier and achieve stronger gains with any positive developments for the future of Brexit and the agreement on a deal to end the state of anxiety that has lasted for years. And even if that was achieved, gains may not last, as the US dollar is still the preferred safe haven for investors in times of uncertainty, as is the case now with the second wave of the Corona epidemic, Trump's health, and other factors that weaken risk appetite. The 1.2800 support will remain important for the bears to control again.

Regarding today's economic calendar data: From Britain, the services PMI will be announced. From the US, the ISM Services PMI reading will be announced.