With the decline of the US dollar in the last trading session last week, there was an opportunity for the GBP/USD pair to correct upward with gains that reached the 1.3048 resistance, its highest level in a month. In general, a rise in risk appetite may be negative for the safe-haven US dollar, which could mean a continued rally for this currency pair. This may be driven by stronger expectations of stimulus from global central banks and governments to combat the impact of COVID-19 on economic performance.

However, if traders choose to focus on the resurgence of COVID-19 cases and the possibility of further lockdown measures, risk aversion may return and the US currency may be preferred. Bear in mind that this could lead to restrictions on trade and travel, which could also add to the problems related to Brexit in the United Kingdom. The sale of the US dollar increased amid news that US politicians were close to approving a stimulus deal, a development that witnessed a rise in stocks and commodities prices while "safe havens" such as the dollar, the Japanese yen, and the franc witnessed a remarkable decline.

The dollar weakened after Treasury Secretary Steve Mnuchin was reported to be preparing to make a $1.8 trillion stimulus offer to Nancy Pelosi. For his part, US President Trump said that negotiations on the relief bill "are moving forward" and urged both sides in more negotiations to "move forward!" On Saturday, however, Democratic Representative and Speaker of the House of Representatives Nancy Pelosi rejected Trump administration’s most generous plan yet, calling it “a step forward, two steps back,” while the Republicans who control the Senate rejected the plan as too expensive and a political lose.

Commenting on the GBP/USD performance, David Sneddon, Technical Analyst at Credit Suisse, said: “The GBP/USD is still well supported, and despite the recent 'reversal day', our bias remains upward for a re-test and finally breakout above key resistance at 1.3007 to confirm that we are witnessing the formation of a larger base process.”

The exchange rate of the pound against the dollar will be subject to further developments regarding the US stimulus bill this week, as well as developments related to Brexit. The US dollar is likely to remain vulnerable to developments related to the stimulus bill this week, with a general rule of thumb that any progress toward settling a deal will be negative for the USD, while reversals are likely to be positive.

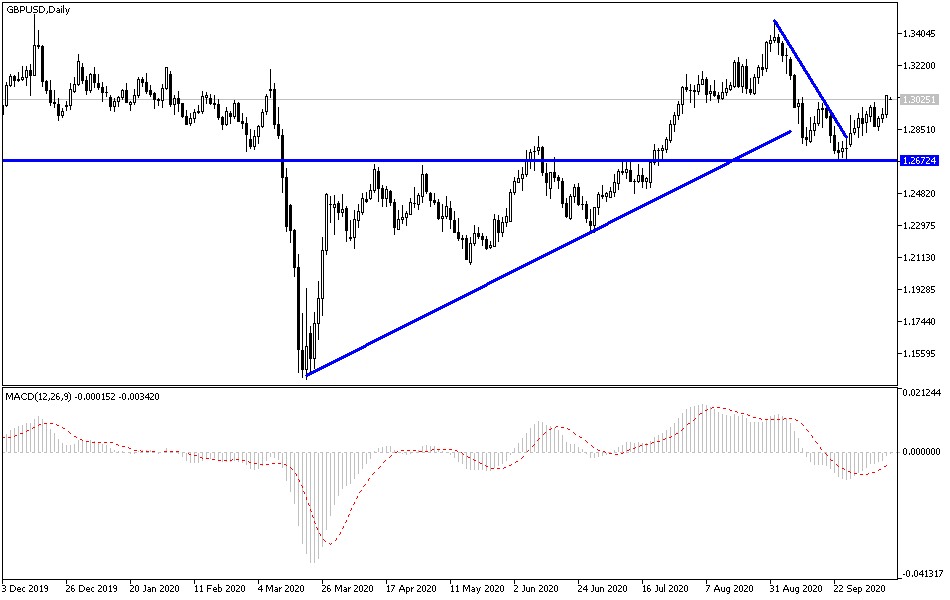

According to the technical analysis of the pair: The GBP/USD is heading higher within a bullish channel on the hourly chart and is testing the mid-channel area of interest. A break above this could take the pair to the top of the channel at 1.3100 which is a major psychological area. The 100 SMA remains above the 200 SMA to confirm that the near term trend is bullish and that the resistance is more likely to break rather than hold. Then again, the gap between the technical indicators narrows to indicate weak bullish momentum and a possible bearish crossover. The stochastic also indicates an overbought or fatigue zone among buyers, and the downtrend may indicate a return of selling pressure. The RSI is already turning lower without reaching overbought territory, indicating that sellers are eager to return.

In this case, a return to the bottom of the channel at the 1.2900 mark could follow, although the moving averages hold as dynamic support as well.