By examining the daily chart of GBP/USD, it seems clear that any chances for the pair to rebound higher would be a selling target, which was always recommended since Britain voted to leave the European Union. What followed from marathon negotiations between the two sides to determine trade relations between them, negotiations that are still dominated by failure. At the beginning of this week's trading, the pair rebounded towards the 1.3024 resistance but quickly stabilized downward around the 1.2935 support at the time of writing. Despite the bleakness of the scene, markets are expecting that the European Union and the United Kingdom will eventually reach a trade agreement after Brexit, although British Prime Minister Boris Johnson said negotiations ended last week.

British Prime Minister Boris Johnson said recently that preparations will be intensified for a trade relationship "similar to that of Australia," which means that the British government is preparing for life without any form of a preferential trade agreement with European Union countries. But crucially, he did not rule out further talks, while the price movement in the sterling exchange rates indicated continued to hope that an agreement could be reached before the end of the transition period on December 31, 2020.

At the end of last week, media reports, quoting a Downing Street spokesperson, indicated that Michel Barnier, the British negotiator, had been told not to come to London unless he was willing to “discuss all issues related to a legal text” or all practical measures regarding a “no-deal Brexit”. This was after the EU’s statement that led Johnson to conclude that “unless there is some fundamental change in approach”, it will not be possible to secure a simple free trade deal with the EU.

So, while the British pound is stabilizing the talks are likely to continue, but it is still far from a “no-deal Brexit”.

Any final announcement of an agreement could lead the pound to close the gap between it and the S&P500 on the charts. As the EUR/USD, AUD/USD, and the NZD/USD all followed this index intermittently for several months, but not the pound. Sterling, which has been weighed down by Brexit and other factors, including the recent outbreak of the Corona pandemic and government efforts to contain it, as Britain tops European figures in the number of deaths from the deadly disease.

In this regard, Wales has become the second state in the United Kingdom to shut down large sectors of its economy to combat the rise in Coronavirus infections, even as British Prime Minister Boris Johnson on Monday resisted loud calls to do the same across England.

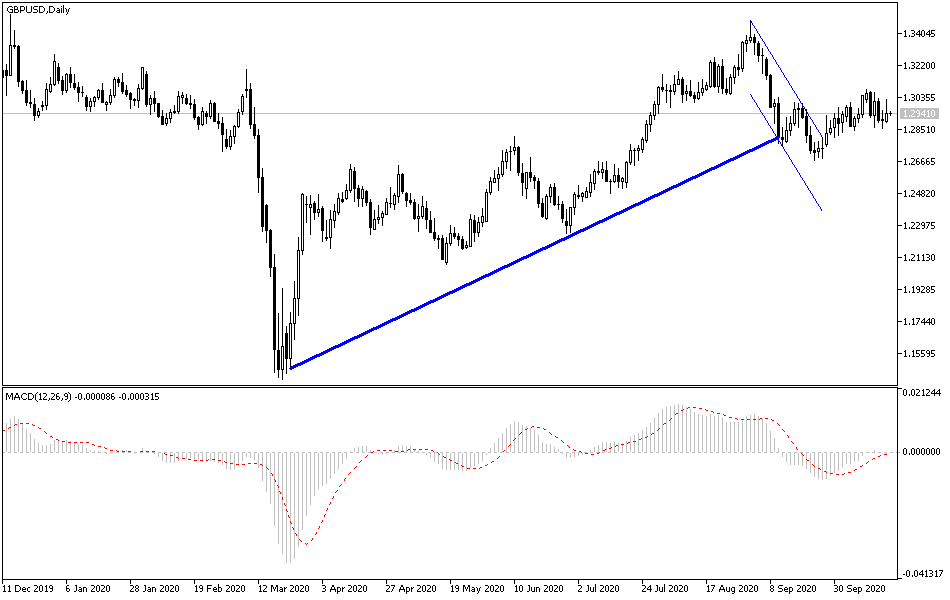

According to the technical analysis of the pair: According to the GBP/USD performance on the daily chart, the pair still needs to stabilize above the 1.3000 psychological resistance to stimulate more buying deals and a real breakthrough for the Brexit negotiations will provide sufficient and important momentum to move towards stronger levels, with the closest ones being 1.3020, 1.3100 and 1.3185. For the moment, GBP gains will remain a selling target. In return, the bears' success in breaching the 1.2885 support will increase the bearish momentum to test stronger support levels and thus collapse the current opportunity for an upward rebound.

As for today's economic calendar data: There are no important British data expected today. From the US, there will be the announcement of building permits and housing starts.