The recent GBP/USD performance continues to confirm the effectiveness of the trading strategy that we recommend in dealing with the pound pairs. That would be selling from every upward level, as the future of Brexit continues to be crowned with uncertainty. This is despite statements of optimism at times and pessimism at other times from the two sides of the Brexit - the European Union and Britain, on the future of their relations after December 2020.

In the middle of the week’s trading, the pair jumped to the1.3007 psychological resistance, its highest level in three weeks, from which it provoked selling again. Therefore, the pair retreated towards the 1.2844 support before settling around the 1.2916 level at the time of writing. Markets are still awaiting the results of the negotiation rounds that are still in place between the European Union and Britain.

Uncertainty about Brexit remains long after the end of the year amid mounting signs that trade talks could extend into next year affecting the path of the Pound against the rest of the major currencies, which has already led to volatility, but at the same time, it has led some expectations for the British currency to be upgraded. For his part, British negotiator David Frost told a House of Lords committee on Wednesday that only companies and families will have a "planned agreement" regarding the terms of the future commercial relationship between the United Kingdom and the European Union when the transition period ends on December 31, 2020, indicating that it is a form of extended transition that may be necessary to avoid a "no-deal" Brexit.

Frost told the UK upper chamber that he and his team were still waiting for decisions by the European Union, but that “very good” progress had been made in the recent talks, including in key areas that had so far hindered a broader agreement, before warning that the deal was still elusive.

He also reiterated British Prime Minister, Boris Johnson's assertion over the weekend that he would be prepared for relations with the European Union on the same terms as with Australia, for example, if the differences between the two sides remained too large to be bridged, preserving the possibility of no deal Brexit from the year-end transition period or after.

Commenting on this, Andreas Steno Larsen, chief forex strategist at Nordea Markets, says: “There are no strict deadlines in the policy, why do we think the two sides can come up with a“smart”delay instead. "They can decide to outline a deal, but they agree that a new implementation period is needed," he added. In practice this would resemble a delay but would be "sold as a bargain".

For the second time, Prime Minister Johnson and European Union Chief Executive Ursula von der Leyen agreed at the weekend that negotiators would work more vigorously and energetically towards an agreement, even as they acknowledged that “there are still significant gaps, especially in the areas of fisheries, equal opportunities, and governance”. They had already agreed on a similar goal in September, that is to make a big fuss at the time but of little use in the talks.

Brussels continues to demand automatic access to British fisheries, the level of which will be negotiated annually, and the continuation of the official say in economic policy matters as the price of the free trade agreement. They say the arrangements are necessary to protect the single market, given the size of the UK economy and its proximity to the European Union. So far, differences of opinion over Brussels demands have prevented a deal from being struck and the clock is ticking now that the British government refused repeatedly earlier in the year to consider submitting a request to extend the transition period.

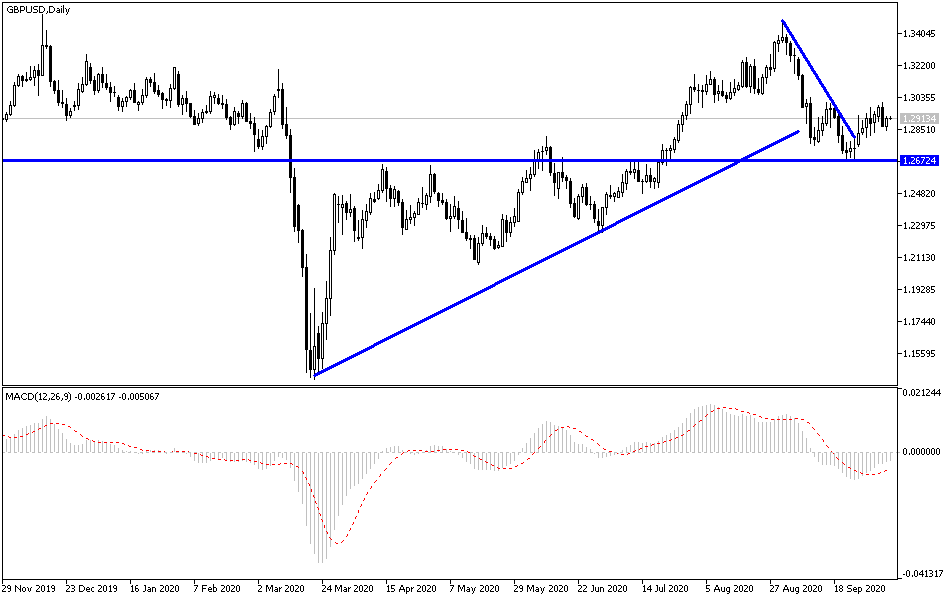

According to the technical analysis of the pair: On the four-hour chart, the formation of the head and shoulders for the GBP/USD performance began to appear towards the support levels at 1.2855, 1.2790 and 1.2680, respectively. On the other hand, bulls are still ready to push the pair upward strongly in the event that a breach in the negotiations is announced and the terms of a much-awaited agreement are released. The future of Brexit will affect the GBP's performance in the coming days and months.

The pair will react to the upcoming statements from the Governor of the Bank of England. Then the announcement of US unemployed claims.