Despite the decline of the US currency, the GBP/USD is unable to fully benefit from the drop, as it remains stable below the 1.3000 psychological resistance. As the pound gains collide with several threats, most notably the future of relations between the European Union and Britain after Brexit and the closure policy in the British economy to contain the outbreak of the Coronavirus. Despite this, the British pound continued to overlook the speech issued by London, which indicates that it is about to move away from trade talks with the European Union, after it was encouraged by European efforts to keep discussions alive, investors seem to be betting that a free trade deal of some kind will be reached at the end.

Brexit negotiators David Frost and Michel Barnier are reportedly due to speak after British Prime Minister Boris Johnson said Friday that trade negotiations are over and that Barnier should not come to London without a "fundamental change of approach" to the talks. For his part, Barnier said on his Twitter account on Monday, sparking skeptical reactions from ministers in London, "... the European Union remains ready to intensify talks in London this week, on all issues, and on the basis of legal texts."

In general, disagreements remain between the two sides at least regarding access to fisheries, while talks have reached a dead end since European leaders called on Downing Street last week to respond to their demands for the UK to adopt a state aid framework for Brussels after the Brexit transition period ends on December 31. On its part, Europe is also seeking "equal opportunity" clauses in a range of economic policy areas and continued access to UK waters for continental fishing fleets.

Commenting on this, Ned Ramblettin, European head of foreign exchange strategy at TD Securities wrote: “We view the UK move as a political stage rather than a fundamental breakdown in the talks, which is likely to start again in the coming days. But the UK strategy is fraught with risks, and it could result in a no-deal. ” “Our current forecast file already includes our base case scenario for a final deal to be reached in the coming weeks,” he added. This makes us deal in a somewhat constructive way with the pound on a long-term basis, especially in the context of the broad US dollar weakness. We are still targeting a rise in the GBP/USD to 1.35 by the end of 2020.

According to estimates by TD Securities. The price of the GBP/USD was once again close to the 1.30 resistance, but it could rise by another 4 percent if a deal was reached and the dollar remained under pressure until the end of the year.

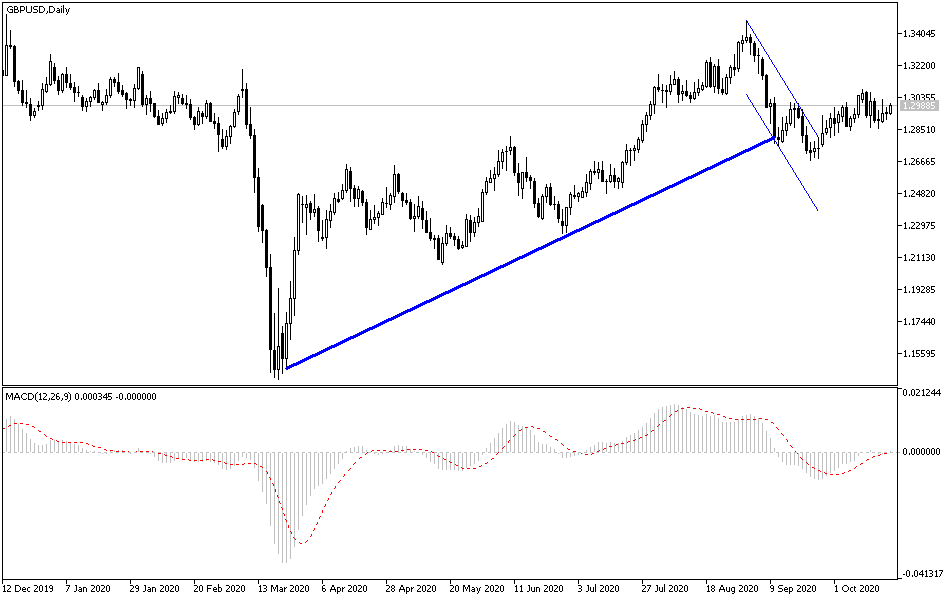

According to the technical analysis of the pair: As I mentioned at the beginning of writing this analysis, GBP/USD gains may face threats, and the upward rebound will not be strong and guaranteed for a longer period without reaching an agreement between the European Union and Britain and alleviating fears of measures to contain the outbreak of the Corona epidemic. if that happens, the pair will have a better chance of an upward correction to reach the resistance levels at 1.3020, 1.3100, and 1.3185, as the first stage of a bullish correction. On the downside, the support level at 1.2870 continues to support the return of the currency pair to the range of the descending channel again. So far, I am still in favor of selling the pair from every upper move.

Regarding the economic calendar data: From Britain, the country's inflation figures will be announced through the releases of the Consumer Price Index, the Producer Price Index, and the Retail Price Index, in addition to the announcement of the public sector net borrowing. There are no significant US economic data expected today.