Instability and extreme volatility was the most characteristic of the GBP/USD performance during last week’s trading. The pair’s movements were in a range between the 1.2856 support, its lowest level in two weeks, and the 1.3082 resistance, and closed the week’s trading around the 1.2907 level. The main reason for the instability in the pair’s performance was the market’s anticipation of what the EU summit will produce last week to define the shape of relations between the European Union and Britain after the transitional period by the end of 2020. This coincided with the British government imposing some restrictions to contain the new Coronavirus outbreak.

Forex market participants are focusing more on Brexit headlines not only now but since the 2016 European Union referendum, but they tend to become more frequent and intense as a big deadline approaches.

The British pound weakened on Thursday to Friday after European Union leaders disappointed British negotiators with no desire to enter a final period of intense negotiations and instead asked the UK to make the concessions needed to reach an agreement. "The European Council calls on the chief negotiator of the European Union to continue negotiations in the coming weeks," European Union leaders said in a statement after the European Council's discussion of Brexit negotiations. The statement also called on "the United Kingdom to take the necessary steps to make the agreement possible."

For his part, chief British negotiator David Frost said in response: “I was surprised by the suggestion that in order to get an agreement, all future moves must come from the UK. It's an extraordinary approach to negotiations.” So the next development in the Brexit saga is likely to come on Friday, as Prime Minister Boris Johnson announced the next step for the UK in response to these developments.

Accordingly, commentators and political analysts say that the talks are now likely to extend to November, with the deadline expected in mid-November given that the EU and UK parliamentarians will need an agreement to ratify before the end of the year regarding this point.

Prime Minister Johnson repeated what was stated in a statement by the European Council on Friday when he said that preparations for a trade relationship "similar to that of Australia" will be intensified, which means that the British government is preparing for life without any preferential trade agreement with the European Union countries. But crucially for the British pound, he did not rule out the continuation of talks with the other side in the hope of reaching an agreement before Michel Barnier, a negotiator for the European Union Commission, arrives from Brussels on Monday, to London.

"The European Council will remain under consideration of the matter," concluded a statement last Thursday, issued by the European Union's Chamber of National Leaders, separate from the European Union's Executive Committee, and headed by a member who is not entitled to vote. "The European Council calls on the chief negotiator of the Union to continue negotiations in the coming weeks and calls on the United Kingdom to take the necessary steps to make the agreement possible."

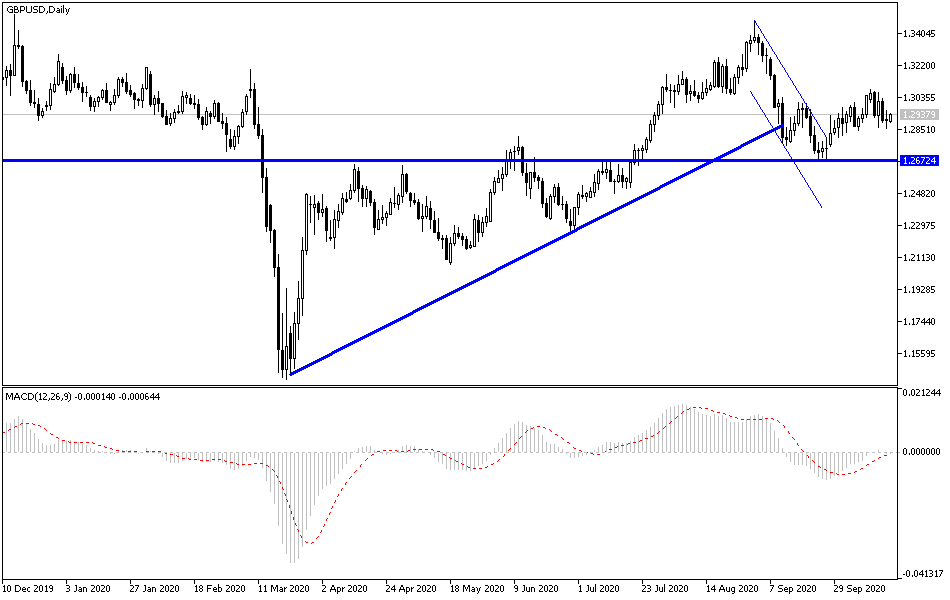

According to the technical analysis of the pair: The GBP/USD could end its rally as the price forms a head and shoulders pattern on the 4-hour chart. The price has yet to breach the neckline around the key psychological level at 1.2900 to confirm the reversal. If this happens, a sell-off may follow, as high as the chart formation. The Head and Shoulders extends around 150 points, from 1.2900 to 1.3050. The price has yet to breach the dynamic 100 SMA support, also to confirm the sellers' dominance. Regarding the topic of the moving average, the 100 SMA is below the 200 SMA confirming the continuation of the downtrend. In other words, the support is likely to break further, and then again, the gap between the technical indicators narrowing to reflect slowing selling pressure and a potential bullish crossover.

The stochastic is still going downward to show that the bears are in control of the performance, but the oscillator is already approaching the oversold zone to indicate fatigue among the bears. A return to the upside could mean that buyers are about to take over and may take GBP/USD back to highs of 1.3050, a minor psychological sign. And also the RSI has more room to move down, so sellers can stay in control of the performance for a longer period and have enough energy to maintain the downtrend.

There is no significant or influencing data expected today but there will be comments from Fed Governor Jerome Powell.