Brexit optimism remains cautious and hence, GBP/USD gains stem primarily from the weakening of the US currency. With the beginning of this week’s trading, the currency pair completes the rebound higher. Gains reached the 1.3082 resistance, its highest level in five weeks, and stabilized around 1.3065 at the time of writing, before the announcement of the British employment numbers and US inflation figures, amid cautious monitoring also of trade relations negotiations between the European Union and Britain and investors’ reaction to corporate profits announcements for the third quarter of 2020 this week. The pound's gains against the rest of major currencies may clash with the results of the impatiently-anticipated European Council summit, which will see both sides assess the progress in trade talks.

There are limited expectations that the two parties - the European Union and Britain - will be able to announce a trade deal this week although investors are at least hoping that Thursday, the UK deadline of October 15 to make progress, will pass without Prime Minister Boris Johnson turning away from the table as previously threatened. The risk is that, even if the concessions are likely to lead to a political agreement on terms of trade sooner or later, domestic political considerations may require somewhat ironic political theatrical, and gestural performances in advance, which may ultimately end GBP gains.

Commenting on the pair’s performance, John Hardy, head of foreign exchange strategy at Saxo Bank, said: “The market continues to price the pound sterling as if a breakout is more likely than none this week, but the situation will inevitably result in large volatility in either direction depending on the results around the deadline next Thursday. The GBPUSD has broken the 1.3000 level due to the USD weakness, while the EUR/GBP fell below 0.9100 without approaching the 0.9000 pivot area. To get below that, we'll likely need a headline deal in principle this week.”

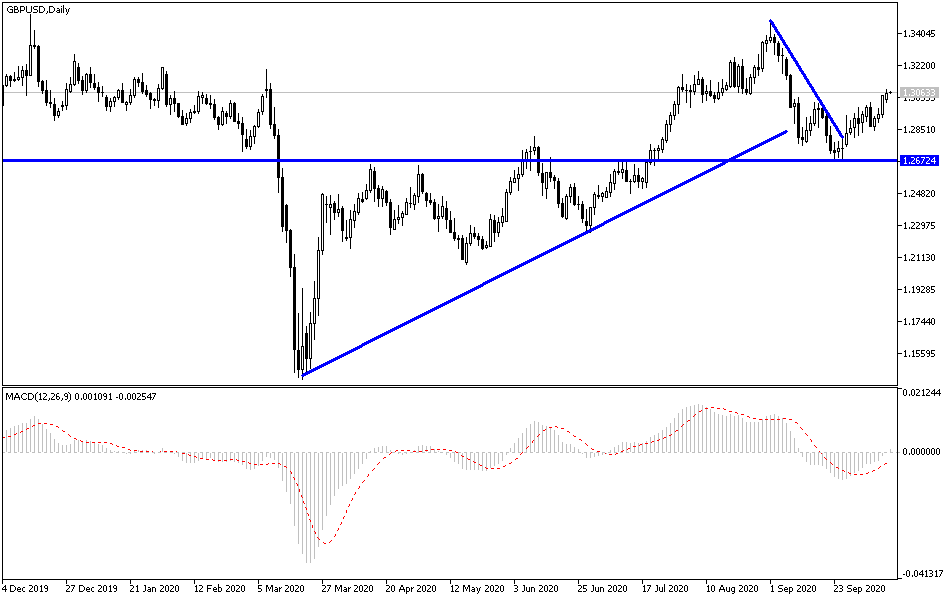

Beware, any decision by Johnson to walk away from negotiations could see the GBP/USD exchange rate head towards the 200-day moving average above 1.27. “We believe the deal will come before the “tough deadline” in late November and will remain supportive of the British pound on the long term”, says Manuel Oliveri, a strategic analyst at Credit Agricole CIB. However, the British Pound may have to endure a bout of political volatility this week.

Any positive progress in the talks could enable the GBP/USD pair to catch up with the S&P500 and other closely related currencies, with a return to around 1.32 at least.

Opinion polls in the US elections will affect investor sentiment in the coming days, in addition to the impact of corporate earnings on indices such as the S&P500, to which the Canadian dollar is strongly positively correlated. Among the big companies that will be announcing their profits are GB Morgan, Citigroup, Bank of America, Goldman Sachs, and Morgan Stanley.

According to the technical analysis of the pair: GBP/USD stability, above the 1.3000 psychological resistance, will continue to support the bulls' movement towards stronger levels and the closest ones are currently at 1.3090, 1.3160 , and 1.3220, respectively. I would like to warn regarding trading the pound, as it is expected to witness strong fluctuations in the coming days, and the outcome of the EU summit and the reaction of the Conservative government led by Boris Johnson will determine the fate of the Sterling in the coming weeks. According to the performance on the daily chart, the 1.2845 level will be supporting the bears to push the pair towards stronger support levels.

As for the economic calendar data today: Regarding the Sterling, the rate of change in British employment will be announced along with the average wages and unemployment rate in the data. Regarding the dollar, the US consumer price index reading will be announced.