Investors abandoned the US currency as a safe haven after announcing the improvement in president Trump’s health condition, who was exposed to Coronavirus symptoms. In addition to the state of optimism about the possibility of reaching an agreement between the European Union and Britain regarding their post Brexit relations after the end of the transitional period at the end of this year. Accordingly, the GBP/USD had a better opportunity to rebound to the upside, with gains reaching the 1.2990 resistance, where it was also stable around at the beginning of Tuesday trading. It is the closest to breaking the 1.3000 psychological resistance, which may happen if the dollar’s decline continued and the picture appears clearer about the possibility of reaching a post-Brexit deal. UK and EU negotiators are preparing for intense Brexit negotiations as the end date for the transition period approaches. The dispute over the politically and strategically sensitive fishing grounds remains a major rift widening the differences between London and Brussels.

UK lawmakers have warned that the row is over European risks. Michel Barnier, the European Union chief negotiator afterward, stated that the chain and ongoing disagreements characterize the Brexit talks. With so much to resolve, and on his part, Boris Johnson, the UK prime minister, and Ursula Kuhn Der Line, the European Union Commission has already agreed to extend negotiations by a month.

Despite the growing risks of a no-deal Brexit, Boris Johnson stated that the nation would prosper strongly under these conditions despite the risk of further disruptions in supply chains. The government has already warned that failure to prepare for a no-deal Brexit could lead to widespread tracking lines. The current COVID-19 crisis will also increase economic costs.

The talks are likely to start this week in London. Also, it is set to continue next week in Brussels. As of today, the European Union has stressed the importance of taking a decision by the end of this month or early next month. Therefore, there is sufficient time to draft the agreement. The British pound may continue to be highly sensitive to Brexit talks as the deadline approaches.

Also, this week we'll see our first Vice President debate between Kamala Harris and Joe Biden. This event will take place on October 7 at the University of Utah. The Vice President discussion will begin at 2100 EST. After the initial presidential debate, the non-partisan Presidential Debate Committee announced its intention to change some elements of the debate. One of the new measures includes the ability to cut the microphone in case candidates continue to interrupt each other. This event would be worth considering in terms of the policy, although it is not yet clear what effect the presidential debate will have on the stock markets.

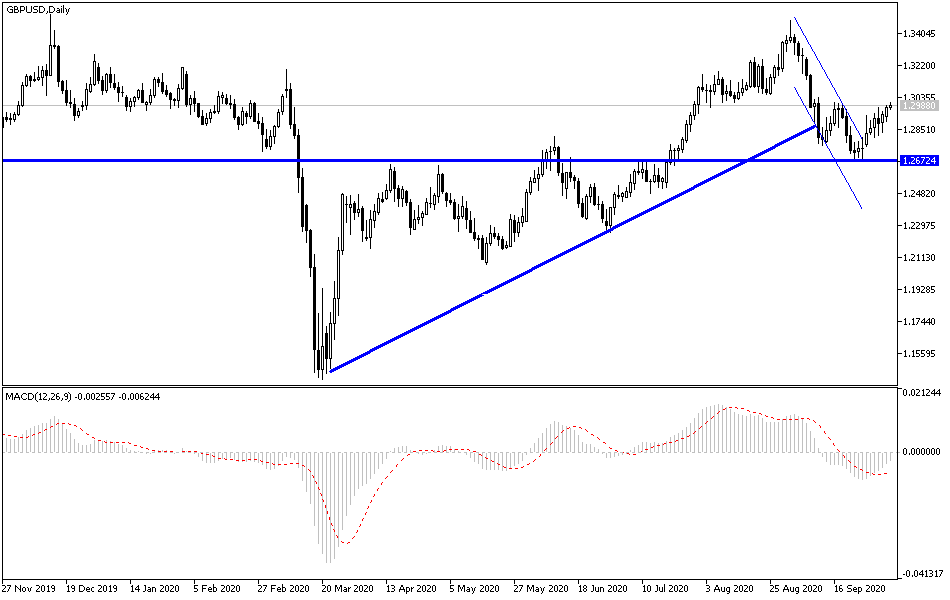

According to the technical analysis of the pair: As I mentioned previously, the bulls' success in pushing the GBP/USD to stabilize above the 1.3000 psychological resistance will trigger new buying operations, and thus test higher resistance levels, the closest of which are currently 1.3055, 1.3120 and 1.3200, respectively. The performance of the pair will remain characterized by extreme volatility in the coming days, until the final announcement of the success or failure of the ongoing round of negotiations between the two sides of Brexit. According to the current performance, the 1.2800 support will remain the most important for the bears to return to control. I still prefer to sell the pair from every upper level.

The most important data on the economic calendar today: Regarding the British Pound, the construction PMI reading will be announced. As for the US dollar, there will be statements by Federal Reserve Governor Jerome Powell and the announcement of the US Trade Balance figures.