By more than 200 points, the GBP/USD pair recorded sharp gains during yesterday's trading session, as it retreated from the 1.2937 support to the 1.3176 resistance before the pair stabilized around 1.3130 at the time of writing. Gains were supported by optimism from the return of the two sides of Brexit - the European Union and Britain - to the negotiating table again after the stalemate and threat that dominated the talks at the end of last week, as well as investors giving up the US dollar, which is facing uncertainty in terms of presidential elections results that will take place early November, besides stalled stimulus negotiations necessary to aid the US economy in the face of the COVID-19 pandemic.

Yesterday, the European Union took a defiant tone with the United Kingdom with the intensification of the confrontation over the resumption of trade negotiations after Brexit, telling the British government "You can't have your cake and eat it." But in return, the bloc's chief negotiator offered an olive branch to Britain, saying that the two sides must concede to reach an agreement. As Michel Barnier said: "Despite the difficulties we have faced, an agreement is within reach if both sides are willing to work constructively if they are prepared to make concessions."

His tone contrasted with the hostile stance of European Council President Charles Michel, who rejected Britain's insistence that the European Union fundamentally change its negotiating position and concede more to the UK's demands. Michel told the European Parliament that if Britain wanted broad access to the markets of the 27-nation bloc, it would have to keep its waters open to European Union fishers, something the UK rejects. “Yes, we want to maintain our fishermen access to UK waters,” said Michael. “Just like the UK also wants to continue to have access to our huge and diverse markets for its companies.”

Britain and the European Union have been trying to hammer out a new trade deal since the UK left the bloc on January 31, 2020.

On the economic side, the UK government has decided to reduce its planned spending review to one from three years as the focus has shifted entirely to Covid-19 responses and job support. Accordingly, the British Treasury said: “The Chancellor and the Prime Minister decided to conduct a one-year spending review, determine the administration’s resource and capital budgets for the period 2021-22, and grant delegated administration for the same period.” The Treasury Department also said that the deadline for the review will be the last weeks of November. The Treasury said that while the government has been wanting to outline plans for the rest of this parliament, the right thing today is to focus entirely on responding to Covid-19 and supporting jobs.

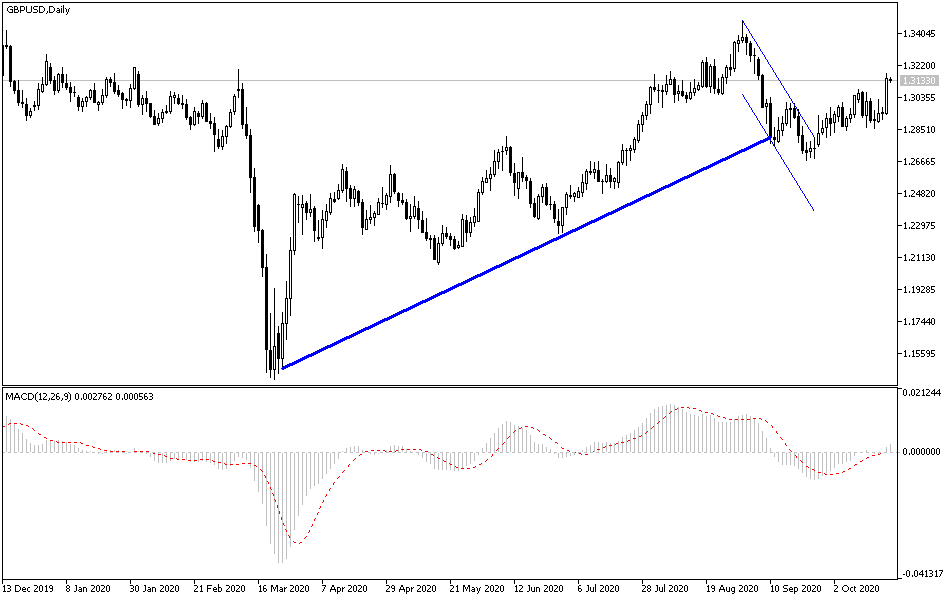

According to the technical analysis of the pair: On the daily chart, a significant upward breakthrough occurred that is important for the future general trend of the GBP/USD, as we expected, stability above the 1.3000 psychological resistance will spark buying operations, and despite the importance of what happened during yesterday's trading session, these gains might face uncertainty about a breakthrough in negotiations between the European Union and Britain, that most affect the pound pairs. Therefore, I still prefer to sell the pair from every upward rebound, and the resistance levels at 1.3180, 1.3220, and 1.3310 are best suited to do so at the present time. On the downside, the pair will not return to its downward path without stabilizing below the 1.3000 level. Government measures in Britain to contain the outbreak of Corona and hinting of the possibility of adopting negative interest rates are additional pressure factors on the sterling.

As for the economic calendar data today: There will be upcoming statements from the Governor of the Bank of England. During the US session, the number of unemployed claims and pending home sales will be announced.