Exploiting the halting of the USD gains and some cautious optimism about the possibility of reaching an agreement between the two sides of Brexit in the decisive negotiations round between them this week, the GBP/USD currency pair succeeded in correcting up to the 1.2946 resistance at the time of writing. The pair is moving in an upward correction range for six trading sessions in a row, in an attempt to compensate for its recent sharp losses. This pushed it towards the 1.2674 support, its lowest in more than two months.

On the economic side, besides Brexit and the reaction to the Corona pandemic, the British economy is still suffering. Yesterday the Office for National Statistics (ONS) said that the British economy contracted less than previously thought in the past quarter, but with the government withdrawing financial support and tightening restrictions on activity, the data does not offer much comfort to the exhausted economy ahead of a possible gloomy winter. Consequently, Britain’s GDP fell by -19.8% in the last quarter, lower than the -20.4% initially announced after reviews in business investment compensated for the reduction in consumer spending and government consumption.

“This is the largest quarterly contraction in the UK economy since quarterly records began in 1955,” the Office for National Statistics said in its statement. “Compared to the same quarter last year, the British economy has decreased by an adjusted rate of -21.5%. It is estimated that the UK's GDP increased by 1.3% between 2018 and 2019; This was revised down 0.2 percentage points from the previous estimate.”

UK business investment continued to decline by -26.5% during the quarter, which remains the largest drop of any single category although it was below the 31.4% decline initially reported by the Office for National Statistics. Meanwhile, consumer spending decreased by -23.6% and government consumption decreased by -14.6%.

On a less serious note, the decline in imports, which are eating up the economy, which was much greater than the decline in exports in the second quarter, as estimates indicate that “net trade” cushioned the impact of the pandemic by adding about 3.5% to GDP. Meanwhile, the household saving rate rose to a record high of 29.1%, from 9.6% in the first quarter, likely due to activity restrictions that inhibited spending and the uncertainty about the economic outlook.

Wednesday's data is a meaningful review but remains lackluster when compared to the size of the pit created by the government's efforts to contain the coronavirus. This has also been partially offset by downgrading the rating to the previous estimate of the first-quarter contraction. Yesterday, the Office for National Statistics added that first-quarter GDP growth was -2.5%, lowering its previous estimate by -2.2%. Moreover, the recovery that began in the third quarter is now believed to have stalled, and with the government withdrawing support for businesses and households, in addition to tightening restrictions, Gregory of Capital Economics says a new downturn cannot be ruled out.

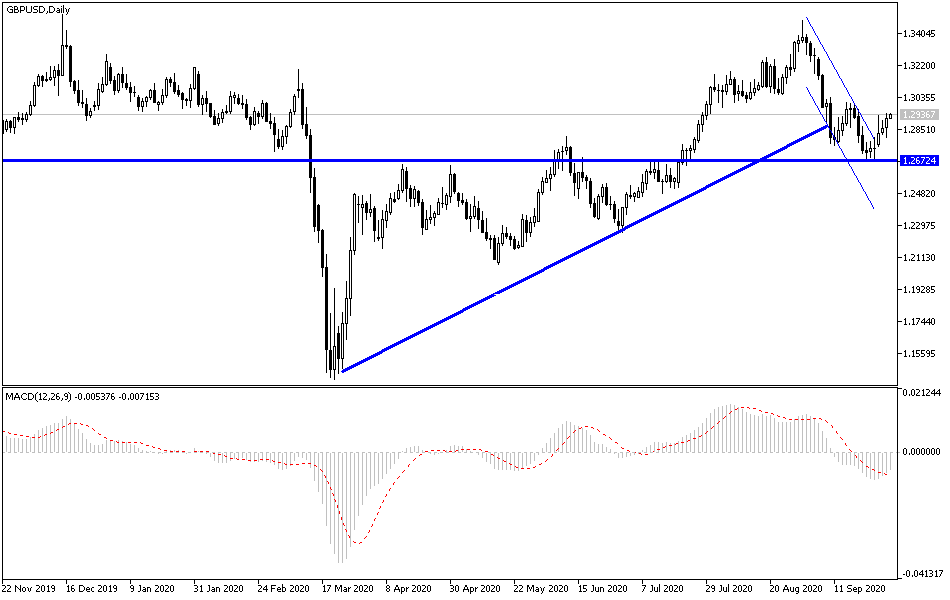

According to the technical analysis of the pair: On the GBP/USD daily chart, it appears there is an attempt to break the last descending channel that was formed since the pair collapsed from the 1.3483 resistance at the beginning of September. This reversal needs stability above the 1.3000 psychological resistance, because it may stimulate more buying and thus move higher, and the closest levels after that are 1.3075, 1.3145, and 1.3300, respectively. It must be taken into account that the results of the current round of negotiations between the European Union and Britain, which will be announced on Friday, will be decisive for the pair’s orientations in the coming days. And if the pair returns to the 1.2800 support area, this means that the bears may move towards stronger support levels. And the idea of current upward correction ends.

As for today's economic calendar data: Regarding the Sterling, the manufacturing PMI reading will be announced. Regarding the dollar, the weekly jobless claims announcement, the preferred inflation indicator for the Federal Reserve, are expected, as well as prices of personal consumption expenditures, the average income and spending of an American citizen, and then a reading of the ISM industrial purchasing managers' index.