The British pound has gone back and forth during the trading session over the last 24 hours, but quite frankly the market continues to look as if it is still trying to figure out what to do with itself. The Brexit continues to be a major problem, as the headlines continue to throw algorithms back and forth. Ultimately, this is a market that will be moving on the next headline when it comes to Brexit, or worse yet, even the most recent rumor.

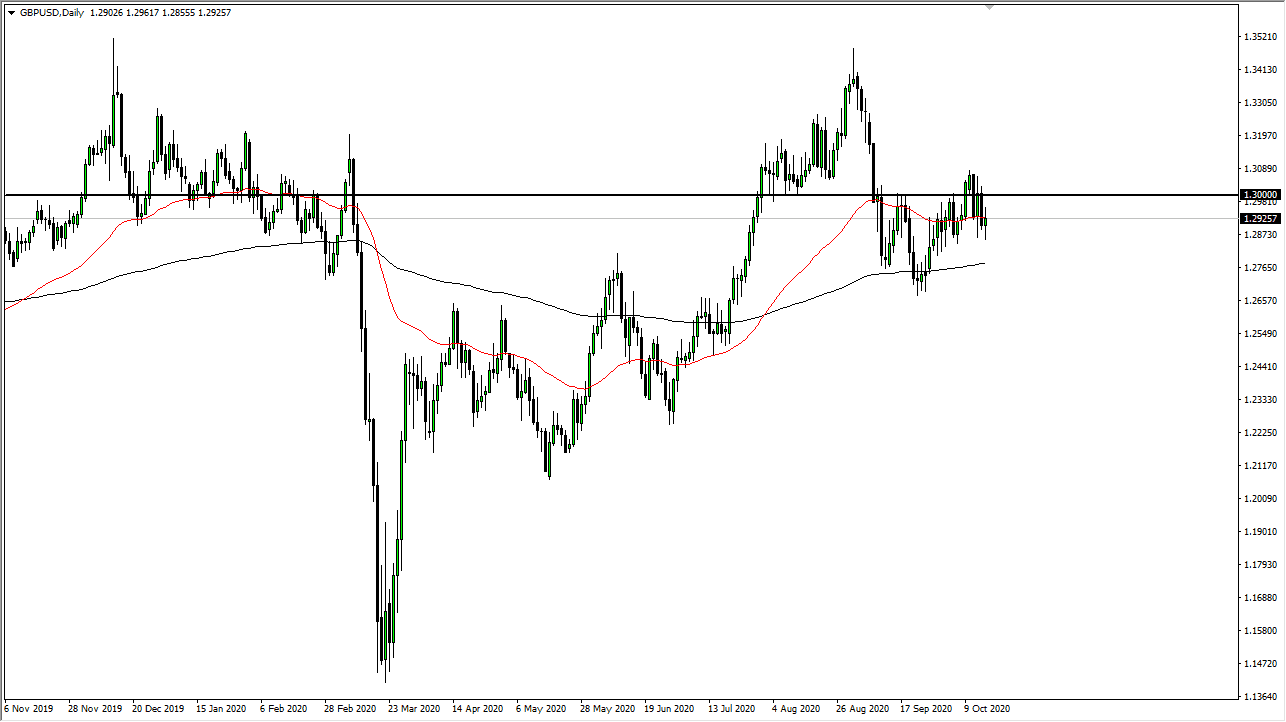

Looking at this chart, the 50 day EMA is slicing right through the action right now, and the fact that we are hanging around that level suggests to me that we do not know where to go next. The 50 day EMA is flat, and therefore it suggests that we have no bias other than choppiness in the short term. This makes quite a bit of sense because we have the uncertainty of Brexit still causing issues. Furthermore, the United Kingdom looks very likely to continue locking down the economy in bits and pieces, so I think at this point it is going to cause major issues for Sterling.

On the other side of the equation, we have the United States dollar, which is currently being evaluated through the prism of a potential stimulus. This is being delayed and therefore we could see a little bit of strength and the greenback. The pair has quite a bit of volatility built into it, as both of these currencies are moving on very major issues. However, if we get a sudden “risk-off” type of situation, this will favor the market to the downside. The 200 day EMA is sitting at the 1.2750 level, an area that has been important on longer-term charts. It would not be a huge surprise to see the market reach down towards there. However, the 1.30 level above makes a nice target as well. I think what we are looking at more than anything else is a lot of consolidation in choppiness until we get towards the end of the year or the US elections at the very least. In other words, this continues to be a back-and-forth short-term trading type of environment that should be played through the prism of a range. Right now, that range is essentially 1.31 at the top and 1.2750 level on the bottom.