I think that the British pound is going to be thrown around by the latest Brexit headlines, and after all we have no idea exactly how Brexit is going to work out. Some people are betting on the fact that there is going to be some type of agreement, but at the same time other people think that it is almost an impossibility. One thing is for sure, politicians are not helping the entire situation.

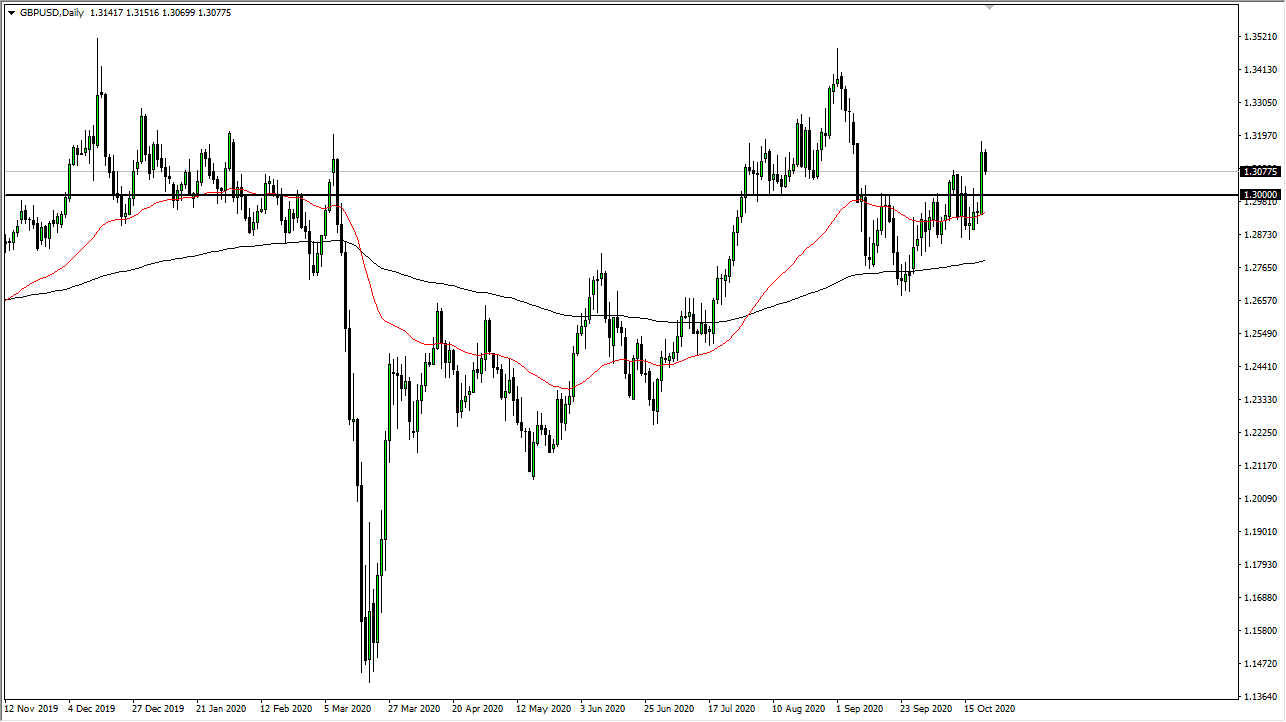

Looking at this chart, we honestly had a very bullish run during the trading session on Wednesday, and the fact that we pulled back a bit on Thursday is not a huge surprise, and we are still above a lot of the bullish pressure from the previous day, suggesting that perhaps there are probably buyers underneath. Having said that, this will obviously be a reaction to the Brexit announcement if and when it finally comes. On the other side of the equation we have the ridiculous stimulus toxic continue to drag on in the United States, so it is difficult to imagine a scenario where this is going to be easy. After all, we have politicians bickering on both sides of the Atlantic about two totally different conversations. This is a recipe for volatility, and I think that is what we are going to continue with.

Underneath, the 50 day EMA sits just below the massive candlestick from the previous session, which should support this market. Having said that, the market is essentially going sideways in general, so I do believe that although there is upward pressure in general, we really at this point in time have no idea what to do with ourselves. I certainly would not be a seller of this pair, because if I wanted to buy the US dollar, I would find another currency to buy it against. This is because there are plenty of other markets that I will be involved in if I am trying to buy the greenback, so this is a “one-way trade” as far as I am concerned. I would be a buyer eventually for some type of value, but right now I need to see a little bit more proof.