The market stopped at the 50 day EMA during the trading session, retracing about half of the ugly candlestick from the previous session. This tells me that there is not as much risk appetite out there as one might believe. For what it is worth, the big move or the US dollar suddenly has become the idea of a potential stimulus package, although that seems to be a far-fetched idea.

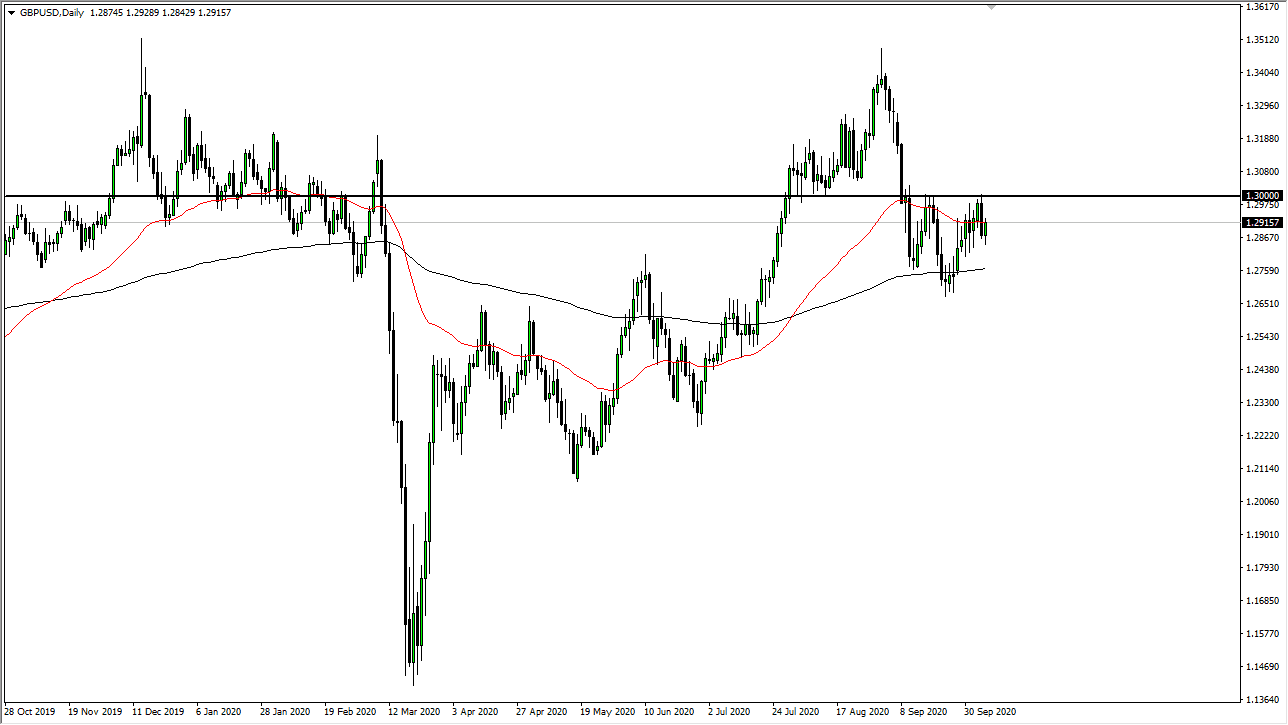

Looking at the British pound, you can clearly see that the 1.30 level is crucial and breaking above there on a daily candlestick would be an accomplishment that you would have to pay close attention to. At that point, it is very likely that the market will go looking towards the highs again, but I think it will be difficult to make that happen without some type of Brexit solution. We have been waiting a few years for that, so to think that it is going to come in the next few weeks is probably a huge stretch of the imagination. One would have to think that a “No deal Brexit” is the default scenario now, meaning that we probably have not seen the last of massive bearish pressure in Sterling.

This does not mean that I am willing to jump in and start shorting right away, just that I recognize that it is going to take something extraordinary to send this market higher. If and when it does, then obviously I will be the first to buy the British pound. This will be especially true if there is some type of massive stimulus package coming out of Washington DC, which of course would work against the value of the US dollar. In fact, you are probably much more likely to see something affect the US dollar as far as news is concerned much quicker than the British pound as it is obvious that the United Kingdom and the European Union are not negotiating in good faith. All things being equal, this pair continues to be a massive headache just waiting to happen, so you need to be cautious about your position size and recognize that you need a clear break of resistance to get long. To the downside, I think we could see the 1.2750 level tested if we get enough negativity but right now it is simply a market that is trading on the latest Tweet.